For exchange-based specialists, prop floor traders and upstairs sell-side market-makers, the notion of buy-side traders putting on the hat of risk-taking market-making is a head scratcher. Sure, there’s a cadre of hedge fund wonks who have interned on a sell-side trading desk, then moved up to Greenwich to grab a slot at one of the many firms run by former trading desk heads who now think they can displace the traditional liquidity providers and do a better job of making markets than their counterparts across the aisle. You know who they are; the ones who get a charge out of bashing their sell-side sales/trader with comments like “Listen, if you can’t fill me right now, I’LL make a two-sided market away from you and prove to you what an idiot you are!”

While sell-side folks scoff at that kind of blasphemy, given the more than two decade process in which electronification has upended equities market structure (and now doing the same to FX, Commodities and UST markets), it shouldn’t surprise anyone that there is growing movement in which buy-side equities traders are plotting to take the model of disintermediation one step further and conjuring up business plans that would have them providing liquidity to the market (via making two-sided markets), instead of their historic role of having a one-sided axe in a particular name.

With that entree, we segue into a fresh-off-the-press column from Shanny Basar at Markets Media “Buy-side Looks to Fill Market-Making Vacuum”….

Nearly half of hedge funds said they would evaluate being market makers in certain securities as banks pull back from some markets, according to a new survey from State Street.

In a report “Let’s Talk Liquidity: Opportunities in a New Market Environment”, State Street surveyed institutional investors on whether market liquidity has deteriorated. Banks have shrunk their balance sheets in response to the increase in capital requirement from regulations such as Basel III, Dodd-Frank and Solvency II and pulled back from some activities. The study had 300 global respondents which included 150 asset owners and 150 asset managers, including 50 hedge funds.

John Bolton, State Street

John Bolton, global head of thought leadership at State Street, said in a media briefing today that 30% of respondents said the liquidity of their institution’s portfolio had decreased over the past three years, while 28% said it was unchanged. Nearly half, 48%, believe decreased market liquidity is a structural issue and not likely to change.

As a result 49% of respondents believe the role of non-bank institutions as providers of market liquidity will increase, with large pension funds and buy-side firms making prices.

If you’ve got a hot tip, a bright idea, or if you’d like to get visibility for your firm through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, etc., please reach out via this link

“43% of hedge funds would evaluate being market makers in certain securities,” added Bolton.

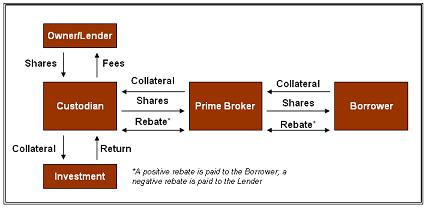

Alex Lawson, head of securities finance, Europe, Middle East and Africa at State Street said at the briefing that in addition to new entrants in market making, the decrease in liquidity will lead to an increase in electronic trading and peer-to-peer connectivity so participants can directly meet their financing needs without the need for intermediaries.

Lawson added: “Regulations have changed the capacity in the market and there are new entrants who have capacity such as Canadian banks and non-banks.”

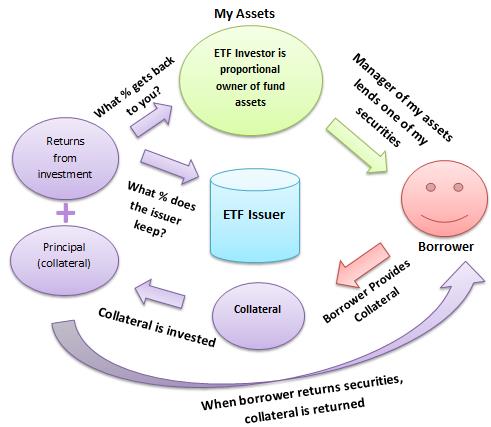

For example, State Street launched an enhanced custody offering in the US seven years ago and in EMEA three years ago as an alternative to traditional prime brokerage financing as the custodian generates large amounts of internal cash. Clients can borrow and finance securities directly with State Street within a segregated custody account.

Lawson continued that the International Securities Lending conference in June included a panel in which two asset owners, including a sovereign wealth fund, and two hedge funds discussed how they were changing their use of the securities lending market and becoming less reliant on banks.

In order to access more liquidity 48% of institutions said they will increase their use of electronic trading platforms and nearly six in 10 believe the electrification of over-the-counter markets will accelerate over the next three years.

“The industry needs to add capacity so we believe in allowing clients to connect in many ways as possible,” added Lawson. “That could include agency lending, across an electronic platform or through facilitating direct relationships.”

The International Securities Lending Association said in its latest half-yearly market report that there have been significant changes in how institutional investors have been using repo and securities lending markets in the past two years.

To continue reading, click here