Taking a Unequivocal Stand is Easier for Fortune CEOs than for POTUS–so it seems. Fortune 500 CEOs who have taken exception to erratic and equivocal statements made by the current sitting president of the United States have been systematically subjected to ‘assault by Twitter’ by the country’s CEO-in-Chief. In turn, their company’s share prices have suffered from sell-offs, as investors fear the “wrath of Trump” will extend to federal government actions intended to harm those companies who have failed to heed Mr. Trump’s so-called “lectures.” Attacks and Counter-Attacks via Twitter has become a contact sport, all thanks to “POTUS.”

Within the context of Wall Street firms, “un-biased and conflict-free” are two phrases that agency-only broker-dealers advance on a continuous basis. These phrases connote their conforming to a fiduciary posture that is intended to protect the interests of their client above all else. When it comes to political discourse, most broker-dealers are loathe to insert themselves in a political fracas, yet other BDs are run by folks whose moral compass overrides their need to keep quiet, regardless of the risk that a regulatory agency such as the SEC or FTC (overseen by Congress) will , at the urging of Mr. Trump, exact some type of revenge for challenging the current president. Courtesy of BrokerDealer.com Editorial Section, MarketsMuse editors join those who are taking the high road, and in that effort, we’re re-distributing a piece that profiles a unique broker-dealer’s viewpoint expressed via trading desk commentary and distributed to their Fortune treasury clients and the leading Wall Street ‘book-runners’. We’ll defer to our readers to click on links leading back to the minority broker-dealer in question. Hint-the firm is the oldest minority broker-dealer owned/operated by Service-Disabled Veterans.

A Special Editorial from BrokerDealer.com: Most Fortune CEOs, as well as leaders of Investment Banks and Broker-Dealers (aka BD) are typically loathe to take a political stand. For the former, making pronouncements that will raise the ire of the current president are likely to be met by “injury by twitter,” or worse still, federal agency scrutiny of the company, which could prove devastating for public company shareholders. For the universe of corporate leaders with a conscience and also recognized thought-leaders, only a few have yet to prove unequivocal when reacting to the equivocal comment made by President Trump when framing his first view of what US Attorney General Sessions labeled as a”domestic terror event.” We’re referring to the white supremacist rally that led to 3 deaths and multiple injuries in Charlottesville, VA this past weekend.

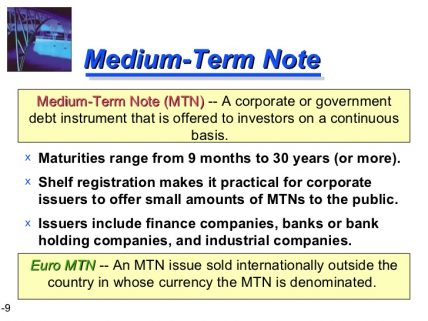

For investment banks and broker-dealers, let’s face it-politics and business mix best with each other when done over cocktails or discrete ‘off-site’ meetings to discuss new capital market initiatives, deal issuance and/or asset management mandates. After all, most traditional broker-dealers eschew taking a political stand that opposes the federal government administration, simply out of fear that the long lips of the current WH CEO will whisper to administration-appointed SEC bureaucrats with a message akin to ‘the right industry regulator might want to make this [firm] go away..” Most, but not all is the catchphrase that compels a re-distribution of a capital markets desk commentary that focuses on fixed income markets and along with a smidgen of geopolitical observations and delivered to a captive group of leading Fortune 500 corporate treasurers, as well as a select group of sell-side syndicate desk ‘book-runners’.

Sponsored by Prospectus.com. Our team of capital markets experts and securities lawyers specialize in preliminary offering prospectus, secondary offering prospectus and full menu of financial offering memorandum document preparation. More information via this link

Here’s the extract of the day’s piece, titled “Risk On, Risk Off, US-NOKO Tensions Subside; Ugly Heads of Racism Take Top Headline…”

Investment Grade Corporate Debt New Issue Re-Cap – A View About Charlottesville and the Aftermath

Risk was clearly back on in the financial markets today, as U.S./NOKO tensions fell to the wayside. Unfortunately prejudice and racism reared their ugly heads in the Charlottesville, Virginia riot over the weekend. On Monday, Fortune 500 thought leaders Ken Frazier, CEO of Merck & C0., Brian Krzanich, CEO of Intel, and Kevin Plank, CEO of Under Armour each took a stand by protesting the ‘equivocal’ comments made by President Trump in his first response to the domestic terrorism acts in Charlottesville, which were advanced by self-proclaimed alt-right and white supremacist neo-Nazis. Mischler Financial Group stands with every corporate executive (and every duly-elected or duly-appointed government official) who stays true to genuinely right-minded beliefs and applauds their respective organization’s dedication to doing right by doing good. In case you missed the memo, many of America’s Fortune corporations adhere to this same notion and advance their commitment via proactive Diversity & Inclusion initiatives.

For those corporate executives who may have spent all of their undergrad time in finance and accounting classes, and for those who are perhaps not as familiar as they could be i.e. American History (let’s not forget to mention world history, too!), racism and bigotry are diseases that spew hatefulness and cannot be allowed in a free and democratic society. The incendiary and incite-full actions for which the various white supremacist and KKK groups are notorious for, are NOT protected by “First Amendment rights.* These are cancers that cannot be discounted or condoned via equivocal platitudes; simple right-mindedness demands they be eradicated.

(*Think Justice Oliver Wendell Holmes Jr i.e. Schenck v United States and also re-visit Brandenburg v. Ohio)

To the above point, one need only re-read the Constitution and the Bill of Rights to appreciate that D&I is part and parcel to our country’s DNA. It is also part of the cultural foundation of many Fortune 500 corporations, including Intel, including Merck, including Under Armour and including many others! D&I infers respect for and appreciation of differences in ethnicity, gender, age, national origin, disability, sexual orientation, education, and religion. But it’s more than this. We all bring with us diverse perspectives, work experiences, life styles and cultures and we presumably all share a disdain for anyone and any group that attempts to dismantle, disrupt and or destroy. Kudos to Mssrs. Frazier, Krzanich and Plank for putting themselves in harm’s way and risk of “injury by Twitter” for being true leaders and staying true to their convictions and their constituents.

Kudos also to the many Fortune executives who have raised their own voices to advocate on behalf of right mindedness, and to those corporate executives such as Jamie Dimon, CEO of Citigroup, who have opted not to resign their volunteer roles serving on “Presidential Councils” in protest to seemingly wrong-headed rhetoric. One can hope they have chosen to remain in their roles so that they can be that much more proactive in their WH-appointed roles and/or similar presidential councils in which they serve as volunteers. These are jobs these business leaders have [presumably] accepted to better the country, not to help advance any political platform or political agenda. How the US Secretary of the Treasury or the Director of the National Economic Council can square the so-called ‘equivocal’ views expressed by the CEO-In-Chief vs. their own cultural beliefs will likely be subject to ongoing self-reflection, external speculation and spirited debate. These are smart folks and optimism demands these administration officials be given the benefit of the doubt, just as it is incumbent on any/every corporate leader to serve as role models for employees, customers and clients; just as right-minded parents do for their own children.

Today’s VIX closed 3 bps tighter versus Friday’s close. Also a reminder that tomorrow is August 15th – “mid-August” – that’s when North Korea’s illustrious “bad boy” proclaimed that he’d have his master plan ready to bomb Guam developed by. One week from today on Monday, August 21st begin joint U.S-South Korean military exercises referred to as Ulchi-Freedom Guardian. The exercise began in our Bicentennial year of 1976. North Korea has annually perceived the joint exercise as “preparation for war.” It is the world’s largest computerized command control implementation. Up to 80,000 American and South Korean troops have participated in this exercise in the recent past. The game will go on for two weeks before concluding on Thursday August 31st. Enjoy the show Mr. Jong-Un. You’ll have front row seats though I recommend binoculars. Here’s lookin’ at you kid! To continue reading the day’s debt market commentary, click here

Continue reading →