The 2016 BEST ETF funds and People in the ETF industry...Each year, ETF.com and Inside ETFs orchestrate a list of Best Of-the top ETF funds and ETF industry players who have made the greatest positive impact on the industry and investors in exchange-traded funds. The nomination process and voting process is overseen by five of perhaps the most influential thought-leaders in the space. With that, MarketsMuse ETF curators are pleased to offer an advance look at this year’s categories and a selection of category nominees. Winners will be announced March 30 2017.

ETF.com and Inside ETFs are pleased to announce the finalists for the 2016 ETF.com awards. The awards are designed to recognize the people, companies and products that are driving the ETF industry forward and delivering new value to investors.

ETF.com Award winners are selected in a three-part process designed to leverage the insights and opinions of leaders throughout the ETF industry.

Step 1

The awards process began with an open nomination period running from Dec. 5, 2016, through Jan. 4, 2017. Hundreds of nominations from participants in all corners of the ETF space.

INSIDE ETFs 2017

World’s Largest ETF Conference

January 22-25

Diplomat Beach Resort, Hollywood, FL

Following the open nominations process, the ETF.com Awards Nominating Committee—made up of senior leaders at ETF.com, Inside ETFs and FactSet—voted to select up to five finalists in each category. Votes were tallied on a majority basis, and concluded this past weekend. The members of the nominating committee were:

- Matt Hougan, CEO, Inside ETFs (Chair)

- Paul Britt, Senior Analyst, FactSet

- Elisabeth Kashner, Director of ETF Research, FactSet

- Dave Nadig, CEO, ETF.com

- Drew Voros, Editor-in-Chief, ETF.com

Winners from these finalists will be selected by a majority vote of the ETF.com Awards Selection Committee, a group of independent ETF experts. Committee members will recuse themselves from voting in any category in which they or their firms appear as finalists. Ties will be decided where possible with head-to-head runoff votes.

Members of the 2016 Awards Selection Committee Include:

- Kim Arthur, Founding Partner, Main Management

- Eric Balchunas, ETF Analyst, Bloomberg Intelligence

- Ben Blaisdell, US Trust

- Rob Glownia, RiverFront

- Ben Johnson, Director of Global ETF Research, Morningstar

- Tom Lydon, Editor, ETF Trends

- Phil Mackintosh, Managing Director, KCG

- Jason Nicastro, Senior Research Analyst, LPL Financial

- Tyler Mordy, President & CIO, Forstrong Global Asset Management

- Todd Rosenbluth, Director of ETF & Mutual Fund Research, CFRA

- Jim Wiandt, Founder, ETF.com

Voting will be complete by Jan. 20, 2017, but results will be kept secret until they are announced at the ETF.com U.S. Awards Dinner on March 30, 2017.

If you’ve got fintech fever, or just a hot tip, a bright story idea profiling global macro, fintech, ETFs, options, or fixed income markets, or if you’d like to get visibility for your firm through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, etc., please reach out to MarketsMuse Corporate Communication Conciege via this link

AND THE NOMINEE CATEGORIES ARE …

Lifetime Achievement Award

Awarded annually to one living individual for outstanding long-term contributions to ETF investor outcomes, whether from a position of media, regulation, product provider, investor or other category. Previous winners are not eligible.

ETF of the Year – 2016

Awarded to the ETF that has done the most to improve investor opportunities and outcomes in 2016, by providing access to interesting areas of the market, lowering costs, delivering new exposures or otherwise creating better results for investors. There is no requirement for this award regarding when this fund was launched.

- Fidelity Total Bond Fund (FBND): The nomination case for Fidelity’s actively managed total bond fund was simple: It crushed its benchmarks and its peers, outperforming 97% of its peer group in 2016.

- Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF (GSLC): The cheapest smart-beta ETF on the market, GSLC attracted nominator attention by offering quant-active exposure for just 0.09% in annual fees. Investors rewarded it with more than $1 billion in net flows.

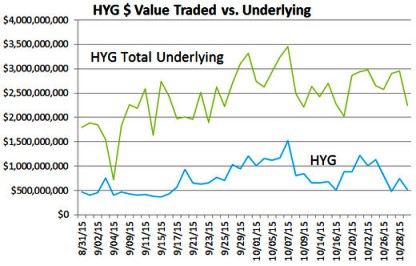

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG): With more than $3 billion in net inflows, HYG is the poster child for the massive rise in interest in bond ETFs in 2016, particularly among institutional investors.

- VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL): Nominees loved the simple investment rationale for ANGL … and the fact that it worked wonders. The fund, which buys debt that has recently been downgraded from investment grade to junk, performed beautifully in 2016.

- Vanguard Total Market Index Fund (VTI): A perennial favorite of the nominating committee, VTI wins plaudits for being a near-perfect ETF, offering broad exposure, excellent tracking, extreme liquidity and a low price.

Best New ETF – 2016

Awarded to the most important ETF launched in 2016.

Note: Importance is measured by the overall contribution to positive investor outcomes. The award may recognize ETFs that open new areas of the market, lower costs, drive risk-adjusted performance or provide innovative exposures not previously available to most investors. Only ETFs with inception dates after Dec. 31, 2015, are eligible.

- Deutsche X-trackers USD High Yield Corporate Bond ETF (HYLB): HYLB got the nod from nominators who applauded Deutsche Bank for adding fee competition into the ETF space: HYLB is priced at just 0.25% compared with 0.50% for its top peers.

- Fidelity Dividend ETF for Rising Rates (FDRR): This intriguing new ETF, which selects firms that have strong dividend payments and returns that are correlated with rising rates, was described as “the perfect ETF for today’s market.”

- JPMorgan Diversified Alternatives ETF (JPHF): “Finally a big name and well-thought-out entrant to the liquid alts space,” wrote one nomination entry, echoing a popular sentiment about an ETF some have called “the hedge fund killer.”

- NuShares Enhanced Yield U.S. Aggregate Bond ETF (NUAG): NUAG solves one of the biggest concerns facing investors: what to do with their bond portfolios. It offers a sensible, rules-based tweak to traditional bond exposure, increasing yield without going crazy.

- SPDR SSGA Gender Diversity Index ETF (SHE): This well-received ETF was the second-fastest growing ETF launched in 2016. It offers, per one nomination, “a unique opportunity to seek a financial return on gender diversity and create change with capital by providing a transparent, relatively low-cost way to invest in companies that have achieved greater levels of gender diversity at the senior management level.”

- Vanguard International High Dividend Yield ETF (VYMI): VYMI won plaudits for offering broad-based exposure to high-yielding companies at a very reasonable fee of just 0.30%. The fund looks not at historical dividend yield, but at expected future yield, to select components.

Most Innovative New ETF – 2016

Awarded to the most groundbreaking and disruptive ETF launched in 2016. This is an ETF that is pushing the envelope in terms of what kinds of exposures can be packaged into an ETF.

Best New U.S. Equity ETF – 2016

Best New International/Global Equity ETF – 2016

Best New U.S. Fixed-Income ETF – 2016

Best New International/Global Fixed-Income ETF – 2016

Best New Commodity ETF – 2016

Best New Currency ETF – 2016

There were no currency ETFs launched in 2016, so this category will not be awarded this year.

Best New Alternatives ETF – 2016

Best New Asset Allocation ETF – 2016

Best New Smart-Beta or Factor ETF – 2016

Best New Active ETF – 2016

Thematic ETF of the Year – 2016

Awarded to the most important “thematic” ETF of 2016, as measured by its ability to capture important macro plays that can lead to specific portfolio outcomes. There is no requirement for this award regarding when this fund was launched.

- 3D Printing ETF (PRNT): 3D printing is super cool, and PRNT is the first ETF to focus on that market. It tracks a tiered, equal-weight index of companies involved in the 3D printing industry, including hardware, software, scanners, measurers and 3D printing centers.

- Spirited Funds/ETFMG Whiskey & Spirits ETF (WSKY): More than just a great ticker, WSKY offers direct exposure to the hottest trend in spirits. With whiskey consumption growing faster than the price of a bottle of Pappy Van Winkle, maybe WSKY is a good bet.

- PureFunds ISE Cyber Security ETF (HACK): Hacking stole the headlines in 2016, whether it was Yahoo, the DNC or Donald Trump. HACK offers pure-play exposure to the firms that fight the hackers, and you have to think that business is doing well.

- PureFunds Video Game Tech ETF (GAMR): Video game contests are now attracting bigger audiences than many professional sports leagues. GAMR offers you a way to “play” that theme, holding companies operating in and around video games and virtual reality.

- SPDR SSGA Gender Diversity Index ETF (SHE): This well-received ETF was the second-fastest-growing ETF launched in 2016. It offers, according to one nomination, “a unique opportunity to seek a financial return on gender diversity and create change with capital by providing a transparent, relatively low-cost way to invest in companies that have achieved greater levels of gender diversity at the senior management level.”

- Summit Water Infrastructure Multifactor ETF (WTRX): Infrastructure spending is top of mind in the U.S., and climate change seems to be putting a premium on water. WTRX captures the trend by finding global firms with water-related equity exposure, choosing the best of the best based on a series of fundamental factors.

ETF Issuer of the Year – 2016

Most Innovative ETF Issuer of the Year – 2016

Awarded to the ETF provider that has launched the most innovative and groundbreaking group of ETFs in 2016.

New ETF Issuer of the Year – 2016

Awarded to the new ETF issuer that has done the most to improve investor outcomes through product introductions, product performance, fund management, investor support and innovation. Issuer must have launched its first ETF in 2016. ETF.com considers “issuer” to mean the “brand” of the ETF, as classified by FactSet.

Index of the Year – 2016

Awarded to the index that has done the most to provide new ways of considering investment strategies, opportunities or ideas, or which has simply delivered for investors in a meaningful way.

Index Provider of the Year – 2016

Awarded to the index provider that has done the most to improve investor outcomes through index introductions, research, advisor support and more.

ETF Liquidity Provider of the Year – 2016

Awarded to the ETF liquidity provider (including market maker, authorized participant, agency broker, etc.) that has done the most to improve investor outcomes through education, support, services, innovation and outreach.

Best Online Broker for ETF-Focused Investors – 2016

Awarded to the online brokerage offering the best package for ETF-focused investors. This award will consider commission-free trading options, education materials, supporting services and other factors.

Best ETF Offering: Wire House

Awarded to the wire house that offer its reps and advisors the best total offering in the ETF space, including research, data, tools, trading capabilities and education.

Best ETF Offering: Independent Regional Broker-Dealer

Awarded to the independent broker-dealer offering its reps and advisors the best total offering in the ETF space, including research, data, tools, trading capabilities and education.

Best ETF Research Paper – 2016

Awarded to the published paper from 2016 that most increased our understanding of how ETFs and/or index-based investments affect investor outcomes, whether in portfolios, markets or broader economic context.

Best ETF Issuer Website – 2016

Awarded to the most informative and user-friendly website by an ETF issuer.

Best Index Provider Website – 2016

Awarded to the most informative and user-friendly website by an index provider.

Best ETF Issuer Capital Markets Desk – 2016

Awarded to the ETF issuer providing the most useful support to advisors for ETF trading.

- Deutsche Bank: Nominations noted that Deutsche Bank made great strides in its capital markets desk this year, to become a true leader in the space. One nominator wrote: “Great partner, incorporated feedback, improved processes, handled complex products smoothly, communicated well, innovative, etc.”

- FlexShares: “Available anywhere, anytime, for analysis, competitive positioning, context or working with a trading desk of another firm,” wrote one nomination, adding that it always “tells it like it is.”

- Goldman Sachs: “Goldman Sachs’ Capital Markets team, led by Steve Sachs, helps clients navigate the ETF marketplace through product education and by ensuring the highest-quality market for the firm’s ETFs,” wrote one entry. They’ve successfully placed a number of large block trades in the firm’s new ActiveBeta suite.

- J.P. Morgan: Nominations called out J.P. Morgan’s desk for being ‘extremely helpful,” and also noted that it was “not afraid to tell market makers what to do.” That sounds like the kind of desk you want on your side.

- SSGA: With a deeply knowledgeable team, nominators called out SSGA’s unique ability to respond to market crises, guide clients, and put things in perspective even in tumultuous times. “A world-class organization from bottom to top,” wrote one nominator.

ETF Strategist of the Year – 2016

Awarded to the ETF strategist or model portfolio provider that has done the most to improve investor outcomes in 2016. Automated investment services are eligible for this award, as they provide managed portfolios en masse to investors.

ETF Lawyer of the Year – 2016

Awarded annually to the law firm that has done the most to push the ETF industry forward, including driving new and innovative products through the Securities and Exchange Commission, advocating for the industry and the rights of investors, and improving outcomes for investors.

ETF Advisor of the Year – 2016

Awarded to an individual financial advisor or advisor team that is using ETFs to deliver high-quality portfolios to clients in an innovative way.

- Chudom Hayes Wealth Management: “Consistently at the forefront of innovation in the industry, this group was one of the first ETF-based portfolio managers,” wrote one nomination paper. Others called out its overall leadership in ETFs within MSSB, where it is “one of the largest users of ETF portfolios.”

- Edelman Financial Services: Regularly ranked the No. 1 independent advisor in the nation by Barron’s, Edelman is a giant, providing high-quality ETF-focused portfolios to the masses (including, admirably, clients with relatively low assets under management).

- Stocker Woods Financial: A heartfelt nomination for Mike Woods called out his 20-year service to Carl Stocker, where he rose from a low-level advisor to become president and CEO this year. In the past year, Woods’ ETF book—managed through a relationship with CLS—has grown dramatically (up 198%).

- Ritholtz Wealth Management: Led by the inimitable Barry Ritholtz and Josh Brown, Ritholtz Wealth offers steady ETF-focused portfolios to a growing client list. Nominations noted the “huge role” the firm plays in the media and its recent decision to reward clients who “don’t monkey around with their portfolios” by lowering fees for clients with good behavior.

- The Veteran Financial Freedom Initiative: This unique partnership offers free or discounted financial planning and portfolio management to veterans, including ETF-only portfolios. The effort is a partnership between Agile Capital, a veteran-owned firm, and Capital Wealth Planning, which funds and covers the operational cost of the effort as a service to veterans.

Institutional ETF User of the Year – 2016

Awarded to an institutional investor that is using ETFs to deliver high-quality portfolios in an innovative way.

- Houston Firefighters’ Relief And Retirement Fund: A nomination wrote: “In 2016, the Houston Firefighters’ Relief And Retirement Fund, led by Ajit Singh, became an early adopter and innovative user of numerous ETF-only investment solutions. As an example, Ajit and his team implemented a “Long and Lend” strategy using ETFs to take advantage of lucrative securities lending revenue. HFRRF is also an advocate for factor investing and thus implemented a solution to four diversified multifactor ETFs across various exposures.”

- Lazard Asset Management: Lazard developed the “Lazard Capital Allocator Series” in 2004, and became an early and leading institutional user of ETFs to provide investors with attractive returns using an innovative investment approach. At a time of continued turmoil in the ETF strategist space, Lazard has been a rock of stability, delivering sensible and solid returns.

- Rockefeller University: Rockefeller has quietly become a major user of ETFs, leveraging the products for transition management for its $2 billion endowment.

- Tennessee Consolidated Retirement System: Tennessee was nominated for its sophisticated understanding of ETFs and its quant-driven approach to sector investing using ETFs.

- USAA: “One of the biggest users of factor ETFs in the world,” wrote one nominator. “USAA has been on the forefront of leveraging ETFs to transform how institutional money managers deliver returns.”

New ETF Ticker of the Year – 2016

Awarded to the ETF with the best new ETF ticker. The ETF must have launched in 2016 to qualify.

- BUZ: Sprott Buzz Social Media Insights

- MENU: USCF Restaurant Leaders Fund

- OLD: The Long-Term Care ETF

- VNLA: Janus Short Duration Income ETF

- WSKY: Spirited Funds/ETFMG Whiskey & Spirits ETF