Goldman Sachs, the venerable investment bank and trading house, has been called lots of things, including “Squid.” But nobody on Wall Street can dispute the fact that $GS is uniquely innovative and perhaps, a firm that can smell the trail of money better than its peers and explains why Goldman is opening a bitcoin trade desk. While JPMorgan CEO Jamie Dimon has repeatedly said bitcoin and other cryptocurrencies are at worst, the foundation to a Ponzi scheme, and at best, a passing fad, Goldman’s CEO Lloyd Blankfein has a different, more open-minded view. As evidenced by last week’s announcement, Goldman is opening a digital asset trade desk to accommodate a growing spectrum of hedge funds, endowments and foundations that already own digital assets or intend to deploy funds to the alt currency asset class. The new digital asset desk will be led by a fellow named Justin Schmidt, an MIT quant jock who previously worked at several quantitative investment management firms, including a hedge fund connected to The Schoenfeld Group.

As reported by NYT reporter Nathan Popper, “…While Goldman will not initially be buying and selling actual Bitcoins, a team at the bank is looking at going in that direction if it can get regulatory approval and figure out how to deal with the additional risks associated with holding the virtual currency….Rana Yared, one of the Goldman executives overseeing the creation of the trading operation, said the bank was clear-eyed about what it was getting itself into…”

Ms. Yared said the bank had received inquiries from hedge funds, as well as endowments and foundations that received virtual currency donations from newly minted Bitcoin millionaires and didn’t know how to handle them. The ultimate decision to begin trading Bitcoin contracts went through Goldman’s board of directors.

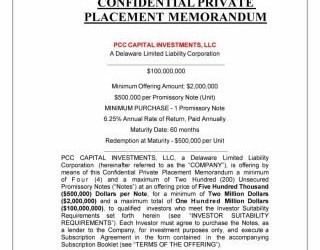

Whether your company is a fintech startup planning a private placement offering, a crypto concern with a custom token offering that is seeking to raise capital from qualified or accredited investors via an Initial Coin Offering (ICO), a Securities Token Offering (STO)or if you are fast growth firm setting the stage for an initial public offering (IPO), a properly prepared offering prospectus or offering memorandum is required by your investors and industry regulators that govern securities offerings. Issuers seeking expert, yet affordable investor document solutions rely on experts at Prospectus.com.

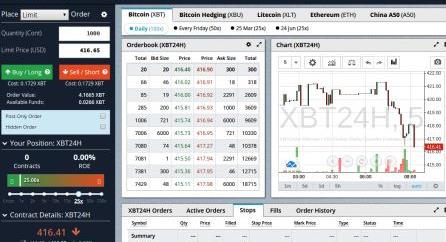

Goldman has already been doing more than most banks in the area, clearing trades for customers who want to buy and sell Bitcoin futures on the Chicago Mercantile Exchange and the Chicago Board Options Exchange.

In the next few weeks — the exact start date has not been set — Goldman will begin using its own money to trade Bitcoin futures contracts on behalf of clients. It will also create its own, more flexible version of a future, known as a non-deliverable forward, which it will offer to clients.

To read the full NYT story, click here.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com.