There continues to be a call for clarity with regard to the topic of corporate bond ETF liquidity and where/how corporate bond ETFs add or detract within the context of investors ability to get ‘best execution’ when secondary market trade in underlying corporate bonds is increasingly ‘illiquid.’

This not only a big agenda item for the SEC to wrap their arms around, it is a challenge for “market experts” to frame in a manner that resonates with even the most knowledgeable bond market players.

MarketsMuse curators noticed that ETF market guru Dave Nadig penned a piece for ETF.com last night “How Illiquid are Bond ETFs, Really?” that helps to distill the discussion elements in a manner that even regulators can understand.. Without further ado, below is the opening extract..

“Transcendent liquidity” is a somewhat silly-sounding phrase coined by the equally silly Matt Hougan, CEO of ETF.com, to discuss the odd situation in fixed-income ETFs—specifically, fixed-income ETFs tracking narrow corners of the market like high-yield bonds.

But it’s increasingly the focus of regulators and skeptical investors like Carl Icahn. Simply put: Flagship funds like the iShares iBoxx High Yield Corporate Bond ETF (HYG | B-68) trade like water, while their underlying holdings don’t. Is this a real problem, or a unicorn?

Defining Liquidity

The problem with even analyzing this question starts with definitions. When most people talk about ETF liquidity, they’re actually conflating two different things: tradability and fairness.

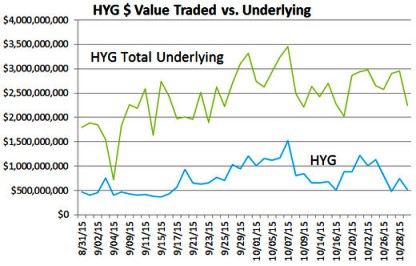

Tradability is actually a pretty simple concept: How well will the market let me get in or out of an ETF? And for narrow fixed-income ETFs (I’m limiting myself to corporates, in this analysis), most investors should be paying attention to the fairly obvious metrics, e.g., things like median daily dollar volume and time-weighted average spreads. By these metrics, a fund like HYG looks like the easiest thing to trade ever:

On a value basis, the average spread for HYG on a bad day of the past year is under 2 basis points. It’s consistently a penny wide on a handle around $80, with nearly $1 billion changing hands on most days. That puts it among the most liquid securities in the world. And that easy liquidity is precisely what has the SEC—and some investors—concerned.

Fairness

But that’s tradability, not fairness. Fairness is a unique concept to ETF trading. We don’t talk about whether the execution you got in Apple was “fair.” You might get a poor execution, or you might sell on a dip, but there’s no question that your properly settled trade in Apple is “fair.”

In an ETF, however, there is an inherent “fair” price—the net asset value of the ETF at the time you trade it—intraday NAV or iNAV. If the ETF only holds Apple and Microsoft, that fair price is easy to calculate, and is in fact disseminated every 15 seconds by the exchange.

But when the underlying securities are illiquid for some reason (hard to value, time-zone disconnects or just obscure), assessing the “fair” price becomes difficult, if not impossible.

If the securities in the ETF are all listed in Tokyo, then your execution at noon in New York will necessarily not be exactly the NAV of the ETF, because none of those holdings is currently trading.

Premiums & Discounts

In the case of something like corporate bonds, the issue isn’t one of time zone, it’s one of market structure. Corporate bonds are an over-the-counter, dealer-based market. That means the iNAV of a fund like HYG is based not on the last trade for each bond it holds (which could literally be days old), but on a pricing services estimate of how much each bond is worth. That leads to the appearance of premiums or discounts that swing to +/- 1%.

To read the full article, please click here