As the events in Greece escalate to a frenzy, global macro strategists are lining up to opine on what might happen as the EU and the world calculate the impact of a Grexit. MarketsMuse tapped into one of the industry’s most thoughtful strategists and one who is notorious for having both ‘sight beyond sight’ and inevitably, a view that is rare when compared to those who position themselves as “opinionators.” Without further ado, below is the extracted version of the 29 June edition of “Sight Beyond Sight“

- Key Talking Points…What People Are Watching…Major Asset Prices

- US Fixed Income – Choke Yourself If You Believe in 2 Rate Hikes in 2015

- China – Correction Accelerates Government Learning Curve & Possibly IPO Reform

We started working early yesterday morning, spending time on the phone with as many risk takers as possible around the world and listening in on numerous bank conference calls on the unfolding events. Additionally, we felt compelled to watch our screens all night. At the time of writing, we have not actioned one item in our model portfolio and are nowhere near able to aggregate the thoughts of the risk takers we respect or the market commentary we received from anyone who writes research for a living. The fact is there is no coherent sentence to write. The dust has yet to settle, and until it does, no one can claim to know what will happen.

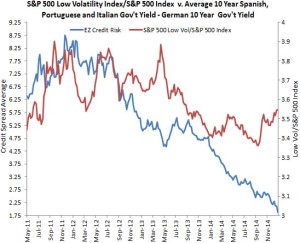

Despite all of this market plumbing being very visible, and even after the Greece referendum news on Friday, the probability of a disorderly financial reaction due to its consequences has only risen to ~40% from 20% or less based on what we can gather. Leaving last week many held the view there was a 50-50 probability for a resolution with a bias for a positive outcome.

Now let’s go through the asset classes and products, and ask how they will perform. For ETF players, our lens is on GREK, FXI, HEDJ and necessarily, SPY. For those looking for an immediate take-away trade with regard to the overwhelming Greek-infused chitter chatter and jibber jabber, think $GLD. In this case, our view, which we have espoused for more than 15 minutes, might or might not be ‘rare’, but its one we can hang our hat on…

Prudent risk management says that the overriding exercise now is to take risk down regardless of your bias on the outcome. Resolution strategies are a distant second place and with US employment Thursday followed by a three day weekend that includes this Greek referendum, that makes this scenario that much more likely.

In terms of Greece, many are watching/waiting for the ECB reaction function to the Emergency Liquidity Assistance (ELA), which is scheduled to be revisited on Wednesday. As a reminder, the events in 2012, in which there was a large spike in the ELA program assistance as a result of Greece, was the catalyst for the now famous “do whatever it takes” speech by ECB President Mario Draghi. Ironically, the three-year anniversary of that speech is coming up shortly and there is no question professionals want to see Draghi re-ignite the European recovery trade. Our point is that faith in him being a steward of the market remains unwavering and he is still the only person perceived as the class act in this goat rodeo.

If we had to pick one asset that we all were led to believe mattered in the context of a “Grexit” over the last five years, and that was supposed to react to that event, it would be Gold. It should be up $50 at a minimum and yet it can barely hold a bid. If you feel bad for the citizens of Greece, then please save a little sympathy for the Gold terrorists at the failure of the yellow metal to respond today. Next week, if things get worse, and gold still fails to respond, that could be the final nail in their coffin. At least there will be one good outcome to the whole sorry saga. Continue reading