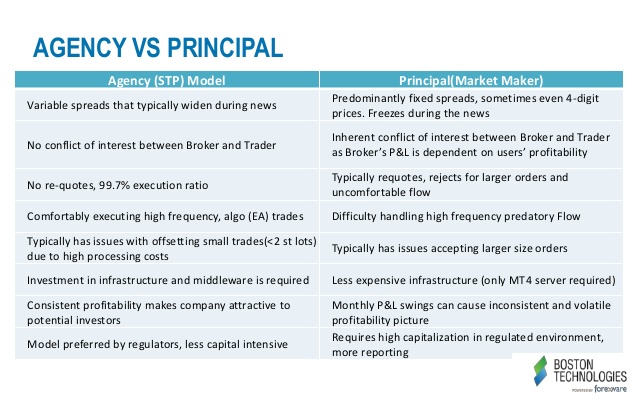

MarketsMuse dip and dash department frequently prefers spotlighting altruists and do-gooders, including Agency-only execution firms in the brokerdealer sphere who, unlike “principal trading desks”, do not take the contra side to institutional customer orders as a means of making a profit; agency-only firms merely execute those client orders via the assortment of major exchanges and dark pools that traffic in equities and equity options. Today’s spotlight is on Dash Financial; the only position they purportedly take is a business model position by promoting the fact they act as a conflict-free agent only representing the best interest of their institutional brokerage clients in consideration for an agreed-upon commission.

The phrase “Best Execution” is therefore popular jargon among agency-only firms and implies that customers are receiving ‘the best” execution. What that means is a function of who you ask, particularly when considering the brokerdealer community has proven uniquely adept at capturing hidden revenue via rebate schemes in consideration for orders routed to those respective venues for execution. These schemes are aggressively promoted by the nearly two dozen major exchange and dark pools that facilitate trading in equities and equity options.

Courtesy of our friends at FierceFinance, today’s altruist of the week award goes to equity and options market agency brokerage Dash Financial, who asserts that being a broker in today’s fast-paced market is about being a technology expert and a consultant on clients’ execution objectives.

Below is the extract from FierceFinance’s interview with Dash Financial’s CMO:

“Everything is a tradeoff,” said David Karat, chief marketing officer for Dash Financial. “Every action you take to minimize fees, you risk losing liquidity, and for every technique to maximize liquidity it will cost you more money because it will be less relevant which venues you go to get that liquidity. It’s that balance we sit on top of and consult with our clients on.”

To that end, Dash Financial aims to help clients achieve what it calls on best net execution – execution that incorporates exchanges fees and all other associated costs.

“If there is liquidity in multiple places we are going to capture that liquidity based on the cheapest economics for the client,” Karat said. But Dash Financial has also designed its tracing architecture to couple its best execution algorithms with a focus on in-depth transparency, Karat said.

“We actually want you to see all the child orders, the millisecond time stamp of which destinations we are going to and what happened,” Karat said.

Looking at an example of a client order to sell 1000 Apple May 106 puts at seven cents, Karat notes that the system not only shows that the parent order was filled, but allows clients to click through to see all the child orders associated with that parent order.

In the Apple example, there were actually 828 contracts available to satisfy the order, divided between two different venues. Dash Financial’s platform is calibrated to account for slight differences in the amount of time it takes for orders to reach different venues, and that calibration readjusts during the day as timing slows down or speeds up. After capturing all 828 orders, the millisecond that the system realized a balance remained, it reversed and posted the balance of the order to Arca, because Arca has the best rebates. The order on Arca was hit immediately.

The Dash Financial interface not only allows clients to see the child orders, but through a tool called Order Trace, clients can view everything including FIX messages sent down to the exchange for a complete audit trail for compliance purposes. In addition, a tool called a Smart Order Router Analyzer allows clients to view what Dash saw on screens at the time or the order.

Dash Financial sees its role as using its tools for visibility into execution to work with clients fine tune trade executions to fit the nuances of their strategy.

“What we do is look at that behavior when they are executing and we might say, in this type of scenario, it might make sense to be a little more aggressive, or a little less aggressive and this is what we suggest,” Karat said. “We will go back and redesign how the algorithm behaves in a certain situation or we will give them another algorithm for a specific nuance, and compare it against existing behavior so we can quantify whether it is worth changing again or keeping as it is.”