You don’t need to be a MarketsMuse or a global macro guru (or any other type of pundit) to know that professional financial market traders are only as good as their last best trade. In that spirit, we look to the 2016 outlook and spotlight on the Wrong Way First (WWF) Trade courtesy of Rareview Macro’s Neil Azous and Sunday night special edition of Sight Beyond Sight–which included a wink and a nod to astrology-friendly traders who swear by the “Bradley Effect”

You’re Only as Good as Your Last Best Trade

You’re Only as Good as Your Last Best Trade

- Wrong Way First (WWF) Trading Explained

- WWF Driving: High Yield (Ignition), Chinese Yuan (Accelerator), US Jobs Report (Speeding Ticket)

- WWF Candidates: Two Real (Japan & Momentum) & Two Fakes (Styles & FANG)

- New Trade: Short EURGBP Spot Exchange Rate

Wrong Way First (“WWF”) Trading Explained

- Wall Street Jargon: Wrong Way First

- Acronym: WWF

- Reference: The risk the professional investment community is exposed to at the beginning of every New Year – that is, the first major trade will be a reversal in the consensus positioning and lead to significant PnL duress.

- Time Frame: 20 calendar days or in this year’s case US equity options expiration on January 22, 2016.

- Candidates: Trend, momentum, sentiment, position, faith-based extremes (not fundamental)

- 2015 WWF Examples: S&P 500 and Swiss franc

- 2014 WWF Examples: Japanese Nikkei and Chinese yuan carry trade strategies

While it is true that substantial wealth is only really created over time (i.e. by investing sensibly), the money management business is still a slave to the Gregorian calendar and that means performance resets at the close of business on December 31st.

Put another way, if you manage money for a living you’re only as good as your last best trade.

Therefore, it should be of little surprise that professionals begin every January more focused on not getting caught up in a New Year’s malaise rather than trying to take advantage of opportunities by adding new risk or pressing legacy positions.

While there are many key conversations underway to start 2016, it is important to highlight that the dominant theme emerging from our discussions with the risk takers we know is concern over a WWF trading theme materializing. Such is the nature of this business, especially for absolute return strategies.

Following a flat-to-negative performance in 2015, our interpretation of these conversations is that, for most investors, there is very little tolerance to withstand PnL duress around any theme that is a current WWF candidate.

It should be noted that the sensitivity to start 2016 is also elevated on account of the much higher than the normal market beta that would be associated with this theme – short commodities and emerging markets.

If you apply this theme to actual positioning it reveals that the top WWF candidates across the major asset classes are:

Equities

- RV: Long Japan and Europe vs. Short/Underweight US

- Quantitative: Long US and EU 12-month momentum

- Style: Long Growth vs. Short/Underweight Value

- Market Cap: Long US large vs. short small caps

- Sector: Long Banks

- Directional: Long stock baskets (FANG, NOSH, Top 20)

Currencies

- Long USD vs. short c/a deficit (ZAR, TRY, BRL)

- Long USD vs. short crude oil (NOK, CAD, RUB)

- Long USD vs. short Chinese yuan (USD/CNH)

Cross-Asset

- Short Gamma

Fixed Income

- Short US front-end

- Long US flattener (2yr/10yr and 5yr/30yr)

- Long 5-10yr Italy vs short Germany Bunds

Commodities

- Short crude oil

- Short base metals

- Long EM oil importers vs. Short exporters

Credit

- Long US vs. short EU High Yield

Personally, while we are mindful, if not darn right respectful of WWF trading, it is not a strategy we look to exploit largely because we are process driven. Additionally, it is our experience that in general contrarian strategies perform badly because they get on the wrong side of trending markets. By that, we mean that the big themes have the ability to persist for a number of years. They do not mean-revert after one year or simply because the Gregorian calendar undergoes its annual reset.

So not only do we tend to side with the majority who look to “weather” a potential 20-day storm, but we hope that a WWF trading event actually materializes and creates enough dislocation to enter positions at much better prices than we initially envisioned to start the year, and at the same time reveal which trends are strong- or weak-handed.

That said, we recognize this is a newsletter and many of you want to actively trade.

So in that spirit, here are the most important questions and answer related to WWF trading to start 2016.

Before that, it should, however, be noted that this year begins with an added twist.

Sometime in the next 72 hours, there will be a “Bradley turn date”. (H/T CP)

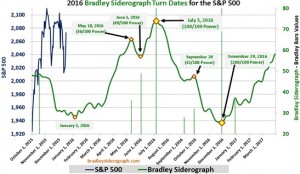

The Bradley Siderograph (literally: star chart) is illustrated below but those who use astrology, numerology and cycle analysis to forecast market turns are highlighting this indicator as a catalyst for risk asset weakness. The 2016 Bradley Siderograph Turn Dates are in green. The first one is January 5, 2016, or this Tuesday.

Note that the siderograph looks like a price chart with smooth sloping lines going up and down. However, the turn dates are only indicators of a change in the trend – not in the direction of the markets.

While we are not ourselves great believers in the ability of the stars to influence the markets, just as we don’t read our horoscopes, it is important to recognize that more professionals follow this indicator than they care to admit in public. For example, disciples of Bradley give themselves a +/-4-day grace period and argue that Equities and Gold are the two assets most prone to turning when it does.

With that in mind, however, here are three things we are watching down here on earth.

WWF Driving – High Yield (Ignition)

- Which asset class matters the most, or is the ignition switch?

- Answer = US High Yield Credit

- Which market proxy is second most important, or the accelerator pedal?

- Answer = Chinese yuan (CNY)

- Which event in the first week of the year breaks the speed limit?

- Answer = Monthly US Employment Report (this Friday)

See the below correlation matrix that shows how the various market proxies are all a “One Beta” trade – they’re all going in the same direction.

To continue reading the 3 January edition of Rareview Macro’s Sight Beyond Sight, please click this link (subscription is required; free trial available without need to insert credit card)