Now that corporate bond fund managers have proven their continuing interest in and use of bond ETFs, State Street and Bloomberg LP are joining hands in an effort to re-define the notion of “straight-thru-processing” for institutional investors that are using fixed income ETF products…MarketsMuse sends a shout-out to BusinessWire for allowing us to re-distribute the below news release.

BOSTON–(BUSINESS WIRE)–State Street Corporation (NYSE:STT) , and Bloomberg, the global business and financial information and news leader, announced today the launch of an enhancement for the fixed income exchange traded fund (ETF) market that helps clients process and settle ETF orders in a more efficient, scalable and automated manner.

As institutional adoption of ETFs continues to increase, this new link between State Street and Bloomberg marks an evolution in how fixed income ETFs trade and settle in the primary market. The enhancement integrates Bloomberg’s Fixed Income ETF Basket service (BSKT<GO>) with TotalETF℠, State Street’s automated, global ETF servicing solution and Fund Connect®, State Street’s online order management system.

Bloomberg’s service allows authorized participants to submit orders directly from BSKT<GO> to State Street and generates in-kind settlement instructions based on transaction messages received from Bloomberg. It will also be available to all ETF sponsors currently serviced by State Street Global Services.

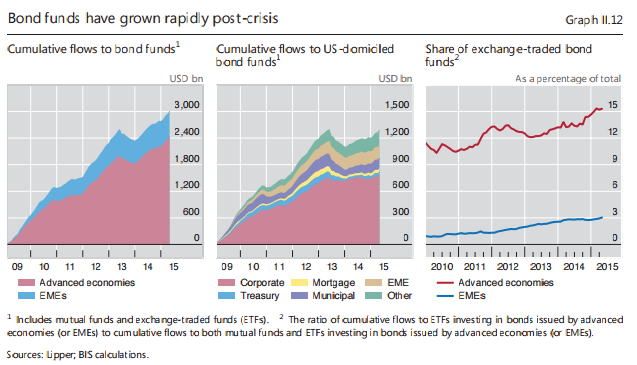

Corporate Bonds and exchange-traded funds is a combination that first seemed counter-intuitive to the select universe of traders who are actually fluent in both corporate bond trading and equity trading; two practice areas that are distinctively different. “Stocks are bought and bonds are sold” as they used to say, and the nuances of trading these distinctive asset classes in the secondary marketplace have long been at odds with each other. This explains why fixed income traders from both the buy-side and sell-side rarely even knew their equity-trading counterparts, no less engaged in cross-asset trading. But thanks to shrinking trading profit margins, Wall Street trading desks now ‘get the joke’, and per story below, are bolstering their business models. (REUTERS) Feb 18 Wall Street banks are ramping up businesses that trade exchange-traded funds full of bonds, a bright spot of growth at an otherwise bleak time for trading but one that may carry unappreciated risk. Barclays PLC, Credit Suisse Group AG and Goldman Sachs Group Inc have all created special teams to make markets in bond ETFs. The teams include staff across stock and bond markets, since the ETFs trade like stocks on stock exchanges, but their underlying securities are bonds. All told, 12 to 15 banks now have a presence in the business, whereas a few years ago almost none did, said Anthony Perrotta, global head of research and consulting at TABB Group. “There are a lot of institutions that, even though they might be retrenching in fixed-income trading, are looking at ETFs as a way to galvanize their business,” said Martin Small, who oversees U.S. operations for BlackRock Inc’s iShares unit, which is the largest ETF issuer. Although these businesses are sprouting up across Wall Street, they are unlikely to make up for huge profits banks earned during the glory days of bond trading, at least not anytime soon. Investors pay banks 0.01 percent to 0.03 percent to trade a bond ETF, according to TABB Group, compared with 1.03 percent for an individual bond. Traders say they are hoping to make up for piddling margins by selling more of the product, since the ETF business is a bulk-volume one that is rapidly growing. The sales push comes after years of pressure from leading ETF creators like BlackRock and State Street Corp to make markets for the bond ETFs. Those firms rake in billions of dollars’ worth of revenue from ETFs each year, and view bond ETFs as a way to grow their own businesses. Firms that create ETFs need banks to act as intermediaries for sales, and also to ensure that prices are in sync with underlying securities. Before banks entered the market, trades were handled by market-makers like KCG Holdings Inc, Cantor Fitzgerald and Susquehanna Capital Group, who have been in the business for years. As Wall Street has warmed to bond ETFs, the market has quickly grown. Assets under management in the U.S. rose 44 percent to $372 billion at the end of January from $258 billion a year earlier, according to fund research service Lipper. That represents about 19 percent of the broader $2 trillion U.S. ETF market. While the bond-ETF boom may be good for Wall Street, it is not without risk. It comes at a time when liquidity in the corporate bond market has shriveled due to new rules that require banks to hold a lot of capital against those securities. As a result, banks avoid buying bonds from investors unless they can resell them quickly, and do not maintain much inventory for interested buyers. Despite their holdings, bond ETFs trade more like stocks, on stock exchanges, so they are not facing the same type of liquidity issue. But it is unclear how they will perform if investors rush for the exit all at once, or if markets come under serious stress. During the Aug. 24 “flash crash,” for instance, some ETFs failed to trade properly. The full story from Reuters is here MarketsMuse ETF and Fixed Income departments merge and gives credit to Morgan Stanley as they raise their own ETF flag with an innovative idea to package a single corporate bond issuer’s debt into one neat package so that ETF investors can express their bets on the issuer’s outstanding credit… Here’s the excerpt courtesy of Reuters: A bank proposal to pool corporate bonds of a single borrower into an ETF-style “trust” to help solve the credit markets’ chronic illiquidity problem is being circulated among issuers and investors, and finding some support. Though still conceptual, the idea initiated by Morgan Stanley reckons investors could find more liquidity in a single instrument that represents several bonds issued by one borrower in a certain maturity, than in the individual bonds themselves. According to the proposal, the trust would get positions in all of an issuer’s outstanding securities in the secondary market. It would then group them according to whether they have short, intermediate or long-dated maturities, and issue separate trust certificates against each of those maturity buckets. An underlying unit of bonds to represent each maturity trust certificate would be created and redeemed in a similar way as existing bond index exchange-traded funds. To continue reading about Morgan Stanley’s new idea for an ETF, click here. MarketMuse update profiles the billions of dollars that have flowed into bond ETFs over the past few years and an in depth look at the reasoning behind it courtesy of the Wall Street Journal . Bond ETFs took in $32 billion globally this year through Feb. 26, according to data from Bloomberg LP, in what has been the strongest start to any year since the funds began in 2002. More than half the $20 billion that flowed into fixed-income ETFs atBlackRock Inc. ’s iShares unit in the first eight weeks of this year came from institutions such as insurers and endowments. In some large funds, institutional money in ETFs has more than doubled in the past few years, the firm said. The shift is the latest good news for providers of exchange-traded funds, which essentially are index-tracking funds that trade like stocks. Bond ETFs are already popular with individual investors because they have low fees and are easy to trade, qualities that are now appealing to more sophisticated investors who typically focus on hand-picking individual debt securities to beat their benchmarks. “There was a monster rotation into fixed-income ETFs in February,” coming out of sector-based stock funds, said Reginald Browne, global co-head of ETF market making at Cantor Fitzgerald & Co. He said a client recently traded $1.8 billion in bond ETFs in a single trade. A host of factors is behind institutions’ adoption of bond ETFs, analysts say. Among them: Deteriorating liquidity in corporate bonds has frustrated large investors as many individual bonds have become difficult to buy or sell quickly at a given price, thanks in part to rules limiting banks’ risk-taking. For the entire article from the Wall Street Journals’ Katy Burne, click here. MarketsMuse.com update courtesy of extract from Jan 6 ETF.com article by Dennis Hudacheck, with a look at Eurobond ETFs $HEDJ,$DBEU, $HEZU, $EZU, $DBEZ, $VGK, $FEZ, $DFE All eyes are on the European Central Bank’s Jan. 22, 2015 meeting, as it’s no secret that ECB President Mario Draghi has been hinting at a large-scale quantitative easing program for some time. There’s no guarantee the ECB will actually implement any such program in January, but the consensus seems to be that there will be some type of big announcement on that front sometime in the first quarter of 2015. At the same time, the U.S. Federal Reserve is expected to begin raising rates in mid-2015. This opposing force between the world’s two largest central banks has strategists calling for a currency-hedged strategy to capitalize on a rising-equity/falling-euro scenario in Europe. An Equity ETF Designed For A Weakening Euro For currency-hedged options, the $5.6 billion WisdomTree Europe Hedged Equity Fund (HEDJ | B-47) is by far the leading ETF in the space. Despite its “Europe” name, HEDJ focuses exclusively on eurozone securities. That means that for better or worse, it excludes the U.K., Switzerland and Sweden, which account for roughly 50 percent of Europe’s equity market capitalization, combined. More importantly, it carries a significant exporter bias, attempting to capitalize on a weakening-euro scenario. The dividend-weighted ETF does this by screening out any company that gets more than 50 percent of its revenues from within Europe. This makes HEDJ geared toward investors with a strong bearish view on the euro. Naturally, the fund favors consumer sectors over financials compared with vanilla, cap-weighted European indexes (MSCI Europe IMI Index). This now-blockbuster fund tracks its index well and trades more than $80 million a day at 3 basis point spreads, keeping overall trading costs very low. ‘Neutral’ Currency-Hedged Products Contrary to popular thinking, investors interested in currency-hedged Europe ETFs don’t necessarily have to be bearish on the euro. They might have a neutral view, and simply prefer a purer equity exposure by taking any currency fluctuations out of the equation.The Deutsche X-trackers MSCI Europe Hedged Equity ETF (DBEU | B-66) is also a leading ETF in the space, and takes a broader approach, including all of developed Europe, beyond the eurozone. It tracks a cap-weighted index and neutralizes exposure to the euro, the British pound, the Swiss franc and a few other European currencies against the dollar. DBEU has more than $710 million in assets and trades with robust liquidity that’s sufficient for small and large investors alike. For a neutral currency take on the eurozone, rising in popularity is the iShares Currency Hedged MSCI EMU ETF (HEZU), which literally holds the $7.5 billion iShares MSCI EMU ETF (EZU | A-63) with a forward contract overlay to neutralize euro exposure. For the entire analysis from ETF.com, please click here Index fund managers are finding it challenging to ensure the bonds they need in the prices they want, driving them to make trade-offs that leave supervisors vulnerable in a market downturn and may hurt investors. Bond liquidity has all but dried up for corporate problems after new regulations and capital requirements compelled Wall Street banks to slash their stocks of fixed income products following the fiscal disaster. That’s especially challenging for index fund supervisors who must get certain bonds to be able to monitor specific standards. The lack of liquidity additionally means funds could have trouble selling bonds in the event interest rates rise and also the investors who have sunk about $1.2-trillion (U.S.) in net deposits into long-term bond funds since the end of 2004 head for the exits. The Financial Stability Board (FSB) is analyzing whether exchange-traded funds pose a hazard to the global financial system for exactly that reason, in accordance with the Bank of Canada’s representative to the committee. Continue reading Sooner or later the bond market is going to start falling, and a perfect exchange-traded vehicle to play the unraveling of the more than three-decade rally in fixed-income markets is “LQD,” a corporate bond fund that happens to be one of the largest fixed-income ETF in the world, James Grant told attendees at IndexUniverse’s Inside ETFs conference this week. But Grant, the editor and publisher of Grant’s Interest Rate Observer, said that while he is short the iShares iBoxx $ Investment Grade Corporate Bond Fund (NYSEArca: LQD), it’s terribly difficult to time such trades, as markets are “unreliably efficient” and “reliably inefficient” and, moreover, the Federal Reserve’s loose-money policies since 2008 essentially mean that interest rates are not in a free market. Grant’s comment about LQD came in response to a question from IndexUniverse Chief Executive Officer and founder Jim Wiandt, who introduced Grant and asked what investors—faced with the prospect of the end of a secular bull market in bonds since the early 1980s—should now do. “Short,” said Grant. “I’m short something called LQD.” The ETF, the iShares iBoxx $ Investment Grade Corporate Bond Fund (NYSEArca: LQD) is quite liquid and has $24 billion in assets under management. Grant, a longtime critic of the Fed and a proponent of a return to the gold standard, was the grand finale at the 6th Annual Inside ETFs conference, which took place in Hollywood, Fla. from Feb. 10-12. The event, which has become the see-and-be seen event in the world of ETFs, was attended by nearly 1,300 people, most of them financial advisors and fund sponsors. Continue reading While growth hasn’t been explosive, one family of defined-maturity ETFs, offered by Guggenheim Investments, a unit These ETFs seek to combine the diversification of a bond fund with the fixed term of an individual bond. A fund with the year 2015 in its name, for instance, will hold bonds that mature in that year—and it will liquidate by the end of that year. But while the interest payment and face value of an individual bond are spelled out up front, the funds’ monthly distributions and payouts at maturity may fluctuate some. “It’s a little different structure” for investors to learn about, says Timothy Strauts, an ETF analyst at researcher Morningstar Inc. The ETFs were designed partly to be building blocks in a “laddered” bond portfolio, where investors buy bonds with staggered maturity dates and hold them to maturity. Traditionally, laddering was done with individual bonds, but getting sufficient diversification can require an investment of $500,000 or more. Investment advisers are the biggest buyers of the funds, but many wanted to see how the funds worked at maturity before buying, says William Belden, head of product development at Guggenheim. Guggenheim BulletShares 2011 Corporate Bond liquidated successfully at the end of last year, the first in the series to mature, and more advisers are now showing interest, Mr. Belden says. See the WSJ for the full article. Forbes columnist Ari Weinberg points out that bond ETFs should be seen as the “money market fund of tomorrow”, and he’s right. Exchange-traded funds (ETFs) are well-positioned to make significant inroads into the US$2.7 trillion money market fund (MMF) sector, which is fighting a fierce rearguard action to maintain the fiction that fund net asset values can be kept stable. In a vociferous lobbying campaign targeted at the US securities regulator, the Securities and Exchange Commission, a long list of US corporate and state treasurers say they can’t imagine a world in which MMFs might be allowed to “break the buck”—ie, have values that could fall below a dollar a share. The chairman and namesake of the Charles Schwab Corporation, which manages US$160 billion in money market funds, told the SEC last month that MMFs are low-risk. “In 2008, at the depth of the financial crisis,” said Schwab, “only one money fund lost value for its clients. It lost one percent of its value; that is just one penny of the US$1.00-per-share price.” But SEC chairman Mary Schapiro offers up a different version of events. She pointed out recently that over 300 money market funds have been bailed out by their sponsors since the 1970s. Just because MMF investors lost out only once or twice because fund sponsors stepped in to hide losses on the other occasions doesn’t mean that there isn’t risk to the whole system, in other words. Continue reading bond ETFsBSKTfixed income exchange traded fundFrank KoudelkaNYSE:STTstraight-thru-processingTotalETF

Bank Trading Desks Merge Bonds and ETFs

Corporate Bond ETFs for Single Issuers??

Bond ETFs Are Growing At Fastest Pace On Record

Institutions are piling into exchange-traded bond funds at the fastest pace on record, driven by forces reshaping the increasingly illiquid corporate-debt market and their desire to stay nimble ahead of expected interest-rate moves.

Institutions are piling into exchange-traded bond funds at the fastest pace on record, driven by forces reshaping the increasingly illiquid corporate-debt market and their desire to stay nimble ahead of expected interest-rate moves.

Euro Exposure? Eurozone Bond ETFs In Advance of ECB’s QE

Do Bond ETFs Pose A Systematic Risk? Regulators Confused, Investors Confounded

James Grant: Short $LQD Before Bonds Fall

ETFs That Mature Like Bonds : Guggenheim Gets It

![]() Courtesy of WSJ Reporter Daisy Maxey

Courtesy of WSJ Reporter Daisy Maxey of Guggenheim Partners LLC, has grown to $1.6 billion since the first funds were launched about two years ago. And a defined-maturity municipal-bond fund group at BlackRock Inc.’s iShares unit has attracted about $220 million.

of Guggenheim Partners LLC, has grown to $1.6 billion since the first funds were launched about two years ago. And a defined-maturity municipal-bond fund group at BlackRock Inc.’s iShares unit has attracted about $220 million.Cash Management ETFs Will Boom..

Commentary below courtesy of Paul Amery, IndexUniverse.eu

Commentary below courtesy of Paul Amery, IndexUniverse.eu