The Fed is Fed Up re Rates Talk…or at least they must be, according to MarketsMuse pundits who have frequently guessed wrong within the context of how much and when the FOMC will decide to upend the current interest rate regime and return to normal. Below excerpt is courtesy of expert debt capital market commentary published 21 Sept 2016 under the banner “Quigley’s Corner”–a daily note delivered to institutional fixed income portfolio managers and Fortune corporate treasurer clients of Mischler Financial Group, a minority broker-dealer and the sell-side’s oldest boutique investment bank/institutional brokerage owned/operated by service-disabled veterans…

It was a no print day today as corporate debt issuers respected both the impact of the BoJ and FOMC.

Not so fast my friends…..not so fast! It’s not exactly a “Dewey Defeats Truman” moment. Still, let’s call it like it is folks – I did say “the next best thing to having tomorrow’s newspaper today is the ‘QC’”. Then on Monday, September 19th and alluding to today’s BoJ and FOMC rate decisions, I wrote, “Fed Holds; BoJ Cuts Rate and Then Some.” Well, I guess it’s not “tomorrow’s newspaper today” but I still think it’s the “next best thing to it.” The Fed Held, the BoJ introduced new fringy though convoluted easing details (“and then some”) but the BoJ kept rates unchanged. Two out of three isn’t bad, but that’s why it’s “the next best thing.” If I played baseball, I’d be in the Hall of Fame with a .666 average. Joking aside, a Fed that infers raising rates by December should have hiked rates today, but they didn’t. This is more of the same readers. Look for Fed members – both voting and non-voting – to continue giving speeches and appearing on television to opine about the rate flux that has restricted so many from doing so much. The street is the leader; the Fed is the ultimate laggard. It’s how it is. Today was more of the same. No surprise at all. The government should consider issuing a gag order on any and all Fed-speak in between meetings for all members, both voting and non-voting. They only confuse the situation and shock markets.

Not so fast my friends…..not so fast! It’s not exactly a “Dewey Defeats Truman” moment. Still, let’s call it like it is folks – I did say “the next best thing to having tomorrow’s newspaper today is the ‘QC’”. Then on Monday, September 19th and alluding to today’s BoJ and FOMC rate decisions, I wrote, “Fed Holds; BoJ Cuts Rate and Then Some.” Well, I guess it’s not “tomorrow’s newspaper today” but I still think it’s the “next best thing to it.” The Fed Held, the BoJ introduced new fringy though convoluted easing details (“and then some”) but the BoJ kept rates unchanged. Two out of three isn’t bad, but that’s why it’s “the next best thing.” If I played baseball, I’d be in the Hall of Fame with a .666 average. Joking aside, a Fed that infers raising rates by December should have hiked rates today, but they didn’t. This is more of the same readers. Look for Fed members – both voting and non-voting – to continue giving speeches and appearing on television to opine about the rate flux that has restricted so many from doing so much. The street is the leader; the Fed is the ultimate laggard. It’s how it is. Today was more of the same. No surprise at all. The government should consider issuing a gag order on any and all Fed-speak in between meetings for all members, both voting and non-voting. They only confuse the situation and shock markets.

First up, let’s look at what the BoJ did while we were in REM sleep this morning:

A Big Red Zero – Land of the Rising “None” as BoJ Keeps Rates at <0.1%> & Introduces More Shifts to Policy

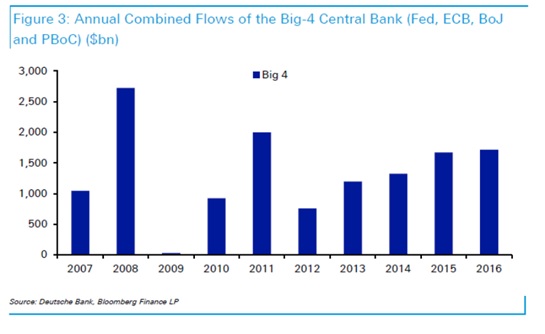

Central Banks from the FOMC to the BOE and from the ECB to the BoJ all seem to be pointing to the downside risks to continued rate cuts while at the same time highlighting that monetary policy needs to be substantially accommodative while calling on governments to share more of the economic burdens. Here’s what’s clear: growth is anemic to non-existent, inflation unchanged to nowhere, accommodative policies are manifesting themselves in new policy twists and turns and big government needs to get more involved. Hmmm…..sounds like things aren’t quite working out, eh?

Here are the talking points from this morning’s BoJ announcement:

o The BoJ left interest rates at its still record low <0.1%>.

o Committed to intervene until inflation reaches 2% and remains stable above that level.

o Will cap 10-year yields at 0.00% by continuing to buy 10yr JGBs implying that the BoJ must continue intervening to prevent borrowing costs from rising and to ensure that it can borrow for a decade for free.

o Changed its policy from a focus on a base money target to controlling the yield curve.

o Pledged to maintain its government bond-buying in line with ¥80 trillion annually while buying fewer long-dated maturities hoping to pump up long-term interest rates thereby helping banks boost profits. There was no expansion of its current quantitative easing program.

Will this new approach be effective? Only time will tell. It certainly is a shift in monetary policy to control the yield curve. It is NOT a bazooka by any stretch and more like “fiddling around the edges.” As for the 2.00% target? Folks, we all know that’s a loooong way off. Market participants have a lot of questions with many sharing that the “BoJ should’ve just cut rates again.” Equity markets loved the news. The DOW closed up 163, the S&P was in the black 23, the VIX compressed over 2.5 and CDX27 tightened 3.2 bps.

“Fed” Up with Rates, FOMC Holds; November Increase Has No Chance Pre- Election and Santa Claus is Coming to Town…with Coal?

The Fed held rates albeit the subsequent press conference was more optimistic, if one can call it that, saying the economy appeared “slightly balanced” and “the case for an increase in the fed funds rate strengthened but decided, for the time being to wait for further evidence of continued progress toward its objectives.” You all know about the myriad global event risk factors out there. There are so many that on any given day in our inextricably global-linked world economy, should one or several of them get worse, which is entirely plausible-to-likely, the Fed can skirt around a hike by once again pointing to global events, as they have in the past, to justify standing down. In fact, in its statement Chair Yellen said, “we will closely monitor inflation and global developments.” What’s more, the next FOMC meeting will be held on November 1srt and 2nd and is not associated with a Summary of Economic Projections or a press conference by Yellen. It is highly unlikely that the Fed raises rates in November given that the meeting will take places 6 days before one our nation’s most tumultuous and raucous elections. Last year saw one rate hike to close out 2015 at its December meeting. Santa Claus will be coming to town early at the year’s last meeting of 2016 held December 13th-14th …………..but don’t be surprised to find coal in the stocking.

Folks, Q3 is about over. You hear that sound? That’s the sound of trucks? They’re backing up to print between now and Election Day – BIG TIME. 12 IG issuers are in the pipeline with a whole lot of M&A deals getting closer.

Here’s All You Want and Need to Know About Today’s Fed Decision

(to continue reading, please visit the Mischler Financial Group Debt Market Commentary page