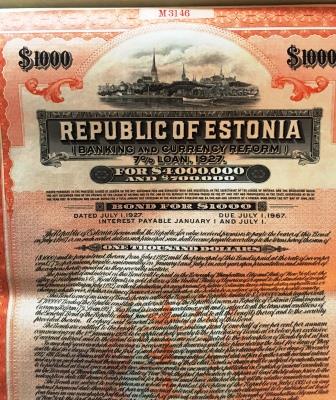

MarketsMuse Exclusive: The Trump-Russia-Estonia Government Bond connection, first disclosed three weeks ago by a MarketsMuse investigative report that linked US Treasury Secretary Mnuchin to a cache of rare, $1000 USD denominated 1927 Estonian Govt bond certificates, has a new layer of intrigue. According to Trump White House sources, last week Estonian Finance Minister Sven Sester […]

Read More