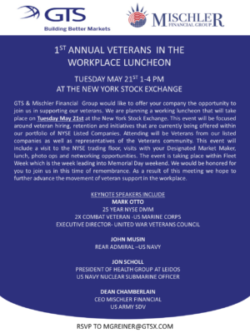

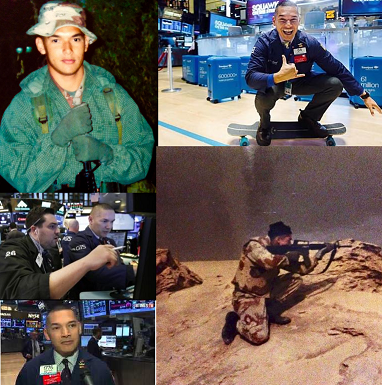

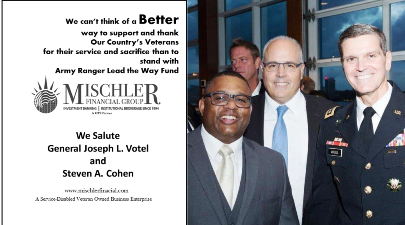

Broker-Dealer Newport Beach, CA & Stamford, CT – November 1, 2018 — Each year, Mischler Financial Group, Inc. (“Mischler”), the securities industry’s oldest investment bank and institutional brokerage owned and operated by service-disabled veterans, pledges a percentage of the firm’s profits to veteran and service-disabled veteran philanthropies as part of its annual Veterans Day charitable […]

Read More