MarketsMuse blog update courtesy of extract from 27 Feb story from ETF.com’s Elisabeth Kashner and her profile of prop trading firm Virtu, the high-frequency (HFT)“Virtu’s HFT Way To Play Crazy Oil Market”

Would you ever sell something to yourself and pay someone else to be the middleman? Nobody’s that dumb, right?

Virtu, the high-frequency trading firm (HFT) of the type profiled in “Flash Boys,” did just that, to the tune of $32 million.

High-frequency traders are perhaps the most sophisticated players on Wall Street. Some might be scoundrels, but they’re not fools. That’s why their recent trades in oil futures-based ETFs are so fascinating.

Like hedge funds and mutual funds, HFT firms keep their portfolios under wraps, except when the Securities and Exchange Commission requires disclosure.

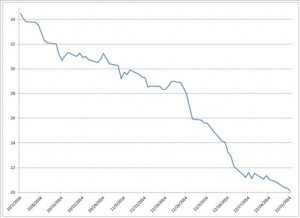

Virtu’s most recent form 13F, the Securities and Exchange Commission’s quarterly holdings report, revealed a $46 million position in United States Oil (USO | B-100) at the close of business on Dec. 31, 2014. USO buys front-month oil futures. By the end of 2014, with oil prices at a 10-year low, USO shares had taken a beating, as you can see in the chart below.

Offsetting Long And Short Positions

USO Volume Weighted Average Price October-December 2014

Data: ETF.com

USO is a great vehicle for a turnaround bet—in this case, a bet that oil prices had bottomed, and were poised to rise.

But that’s not the bet Virtu made. Virtu actually made a pair of bets—the $46 million in USO, and an additional $16 million in the PowerShares DB Crude Oil Double Short ETN (DTO).

Double short—that’s key.

The word “short” in the fund’s name means that DTO has sold oil futures. It’s essentially taking the other side of USO’s bet, by selling the futures that USO buys. The “double” part means that DTO is leveraged, designed to produce twice the daily returns of those front-month, short-sold futures.

Here’s how it works out:

Virtu’s Offsetting Oil Futures Positions

| Ticker | Fund Name | Leverage Factor | Value | 2015 YTD Flows ($M) |

| USO | United States Oil | 1 | 46,213,000 | 46,213,000 |

| DTO | PowerShares DB Crude Oil Double Short ETN | -2 | 16,099,000 | -32,198,000 |

As of Dec. 31, 2014. Data: Securities and Exchange Commission.

Virtu’s combined oil exposure netted to $14 million on Dec. 31, 2014. Put another way, Virtu hedged its $46 million oil futures bet by … selling oil futures.

You read that right. Virtu has been selling oil futures to itself and paying US Commodity Funds and PowerShares for the privilege, not to mention any exchange fees or margin costs.

The people at Virtu aren’t dumb. In fact, they’re very, very clever.

Virtu’s not actually making a bet on oil prices. Instead, it bet on oil volatility, and on the consistency of its price changes.Let me explain.

To continue reading, please visit ETF.com