It doesn’t take a “markets muse” who speaks in tech talk to know that Fintech is not only fashionable, its now mainstream. And, whilst the early “jibber jabber” surrounding Bitcoin was fodder for Wall Street naysayers, including JPM’s Jamie Dimon, “the worm has turned” according to NYT columnist Nathaniel Popper, a bitcoin expert and the author of “Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money.”

For earlier MarketsMuse coverage of the bitcoin and blockchain movement, click here

In Popper’s most recent NYT column profiling the cadre of banks, along with assortment of startups founded by banking expats, the fintech fascination is less about bitcoins as a currency, and all about the blockchain technology that powers the virtual currency.

MarketsMuse Editor Note: Though some of skeptics sitting on the MarketsMuse editorial stools suggest that these fintech applications should be targeting industries that actually embrace innovation, such as online gambling and adult entertainment, we won’t diss anyone by selling near-term straddles.

“…Nowhere, though, are more money and resources being spent on the technology than on Wall Street — the very industry that Bitcoin was created to circumvent.

“There is so much pull and interest on this right now,” said Derek White, the chief digital officer at Barclays, the British global bank, which has a team of employees working on about 20 experiments that explore how the technology underlying Bitcoin might change finance. “That comes from a recognition that, ‘Wow, we can use this to change the fundamental model of how we operate to create our future.’”

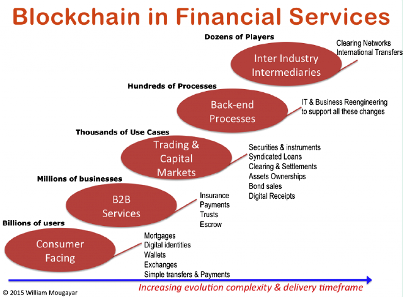

For people like Mr. White, Bitcoin isn’t just a digital token to use for online purchases. Instead, many of the top minds in finance have come to believe that the software that brought the virtual currency into existence also enables a fundamentally new way of transacting and maintaining records online — allowing people and banks to directly exchange money and assets like stocks and bonds without having to rely on a long chain of expensive middlemen…”

A few banks have gone public with their work, but most of the activity has been happening behind the scenes. At one private meeting, held in April at one of the Manhattan offices of Bank of America, executives from more than a dozen large banks gathered to confidentially discuss how the technology underlying Bitcoin could be used to change foreign currency trading, the largest financial market in the world, according to people who attended the meeting.

Central banks like the Federal Reserve and the Bank of England have their own teams looking at the technology.

“A year ago, it was more of an idea,” said Max Neukirchen, the head of corporate strategy at JPMorgan Chase. “Now, it is a real opportunity. You test it and realize that this can play a big role in our thinking about how our own infrastructure will evolve.”

Who are the players to watch? Aside from the secretive projects inside of each of the 6-pack shops (including JPM!), major exchanges including NASDAQ and NYSE owner ICE are actively throwing resources at blockchain technology applications. On the startup scene, Dave Rutter, a former inter-dealer broker who was a head capo at Prebon Yamane, and then CEO OF ICAP before starting electronic broker LiqudityEdge is now wearing two hats via his role at blockchain wannabe R3CEV LLC. Not to be outsmarted is Mark Smith’s “Smart Securities” product, created by his startup Symbiont. Smith is the former co-founder and COO of Lava Trading and a certified tech wonk with a keen FX markets expertise. His company, with help from fintech merchant bank SenaHill Partners has so far outfoxed R3CEV by having already set the stage to facilitate the first corporate bond issuance using the blockchain technology.

For Nathaniel Popper’s latest commentary “Bitcoin Technology Piques Interest on Wall St”., please click here