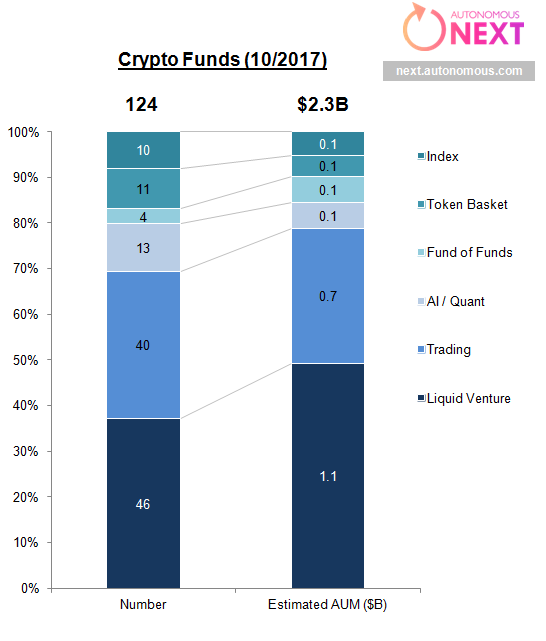

Crypto Hedge Funds Get Their Greenwich On. If the MarketsMuse curators have avoided bidding on and publishing tick-by-tick coverage of "crypto mania" and bitcoin bubblelicious bytes akin to our media industry brethren, its only because we were arguably a pioneer when, starting in 2014, we first started framing the bitcoin and distributed…Read More

What's Next for Option Markets? A CFTC regulated platform for bitcoin options; NY-based firm gets approval to trade puts and calls on cryptocurrency. For bitcoin aficionados, the road to legitimacy has been pockmarked with obstacles and detractors, including those who have insisted that bitcoins are the currency of money launders,…Read More

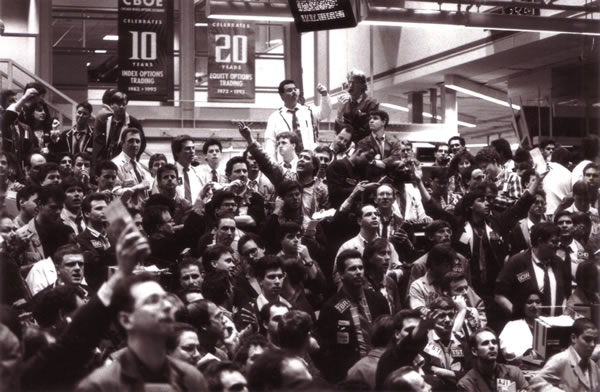

Electronic Exchange Box Options Exchange LLC plan to re-introduce open-outcry trading for options met with derision by competitors.. The first thought that came to this writer's mind when reading the WSJ headline in today's front page "Proposal to Launch Options Trading Floor Stirs Outcry" which profiles a contentious effort on…Read More

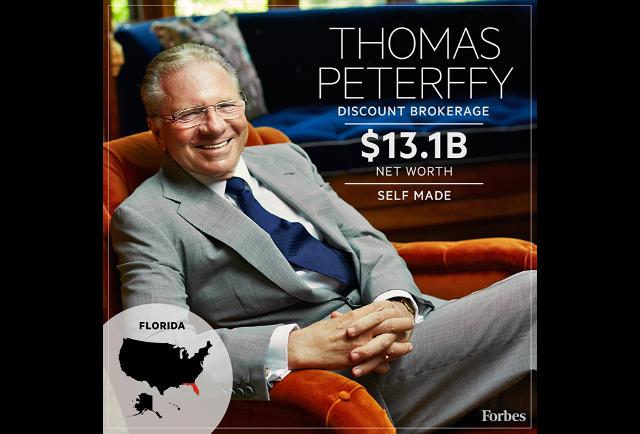

(FinanceMagnate)--Electronic trading firm Interactive Brokers Group, Inc. (NASDAQ:IBKR) aka “IB”has announced its plans to put an end to its options market making activities globally. The operations, which are conducted through the Timber Hill companies, are expected to be phased out over the coming months. The broker will continue carrying out…Read More

Those of us who have worked in and/or around the world of electronic trading for more than 15 minutes readily know about REDI, the ubiquitous direct access execution platform for stocks and options that was introduced by Spear Leeds & Kellogg in 1987 to its professional clearing customers, a universe…Read More

Following a decade of new exchange launches, which led to a series of aggressive fee competition to attract order flow and elevated the 'pay-for-order-flow' game, the more current trend towards consolidation, fueled by an industry-wide race to zero fees and commissions is sparking rumors that the CBOE and BATS are…Read More

"Report Cards" Delivered to Brokerages Citing High-Speed Manipulative Practices, Including Spoofing and Layering (WSJ) --Finra, the securities industry’s self-regulator sent out its first monthly “report cards” to brokerage firms warning about manipulative superfast trading practices, marking the beginning of an effort to encourage the firms to cut off traders that…Read More

In effort to thwart the "Catch Me If You Can" crowd, the SEC has proposed a new audit system that will purportedly allow regulators to track every bid and offer submitted to stock and options exchanges in effort to catch market manipulators. (WSJ)--U.S. market regulators on Wednesday proposed a massive data repository…Read More

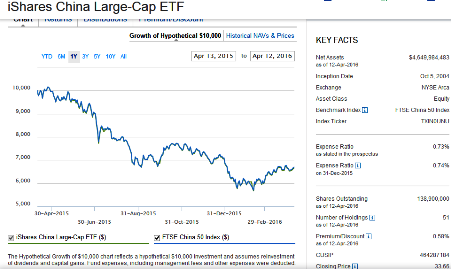

For those following global macro think tank Rareview Macro's "Sight Beyond Sight", you already know that the firm's chief strategist Neil Azous is on a roll and the firm's model portfolio is outpacing many who have an ax in global macro style investing. Today's edition of the firm's commentary caught…Read More

(Bloomberg)-In what merger-arbitrage experts might call a 'take-under', Nasdaq Inc. is paying less than half the price for what ISE traded for in its last price setting after it agreed to buy Deutsche Boerse AG’s International Securities Exchange for $1.1 billion, catapulting it to the top of the U.S. options…Read More

Exchanges Battle Each Other to Create Competing Fear Index Products, out of fear of losing market share. Another index product to "measure" investors' fear?? Are they bats?! As MarketsMuse Chief Curator says, "Yes, Matilda, I'm afraid to say there is yet another new fear index" intended to compete with the…Read More

If not as widely-covered as the GOP or DNC primaries, financial industry publication Wall Street Letter ("WSL") held its 5th Annual Institutional Trading Awards ceremony last night at NYC venue 583 Park Avenue and recognized best-in-class broker-dealers across 7 major categories, including Best Broker Dealer (OverAll), Best Broker-Dealer Research, Best…Read More

Referring to anyone as 'being impaired' is not a compliment. And, in the world of financial market punditry, where at least half of the experts are best at telling their audience what happened during the past 12 hours, while another 45% who position themselves as forecasters are right maybe 50%…Read More

MarketsMuse curators have canvassed assortment of guru-types who have attempted to decipher Friday's stock rally, along with tuning in to the abundance of Monday morning quarterback views. For those who turn to the cartoon channel (i.e. CNBC), some pundits call it a dead cat bounce, more optimistic professional traders and…Read More

(MarketsMedia : not to be confused with Madmen Media, owner of MarketsMuse.com)- In order to keep up with the demands of today’s high-volume electronic markets and leverage their fintech muscles, the Chicago Board Options Exchange, the top options mart player plans to migrate its CBOE and C2 options markets as…Read More

You don't need to be a MarketsMuse or a global macro guru (or any other type of pundit) to know that professional financial market traders are only as good as their last best trade. In that spirit, we look to the 2016 outlook and spotlight on the Wrong Way First…Read More

9 November (BrokerDealer.com)--Broker-Dealer Mischler Financial Group (“Mischler”) , the securities industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans announced that in connection with the firm’s annual recognition of Veteran’s Day, Mischler has pledged a portion of the firm’s entire November 2015 profits to The…Read More

MarketsMuse Strike Price curators are always looking for smart perspectives on how to bring more asset managers and institutional investors to better understand and embrace the use of options in a responsible manner. According to Todd Hawthorne, lead portfolio manager of Boston Partners, volatility [which some immediately and sometimes, misguidedly…Read More