MarketsMuse blog update profiles a proposal from FINRA which proposes pre-trade transparency for fixed income automatic trading systems operators. This update is courtesy of Traders Magazines' article, "A Step Closer to a Fixed-Income NBBO" with an excerpt from the article below. A modest proposal made by the Financial Industry Regulatory Authority (FINRA)…Read More

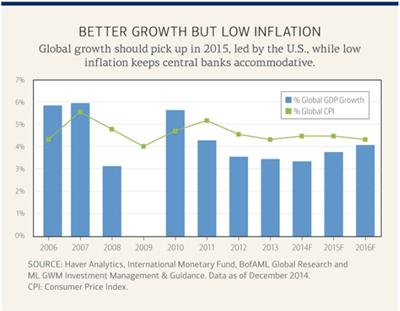

MarketsMuse.com update provides insight for those who are focused on the global macro approach to a topic that many of the world's leading hedge funds and professional investment managers are fixated on: fixed income. Below thoughts are courtesy of the 27 March a.m. edition of "Sight Beyond Sight", the investment…Read More

MarketsMuse.com merges Fixed Income and FinTech with continuing coverage of the corporate bond market’s effort to evolutionize via electronification with a focus on yet the latest innovator initiative courtesy of Goldman Sachs alumni Amar Kuchinad and his start-up“Electronofie.” Our hats are off in salute to the catchy company name and…Read More

MarketsMuse Global Macro update profiles perceived opportunities from the perch of Denmark’s Saxo Group Mads KoefoedIt and his view that interest rate increases probably won't happen during the second quarter, but the market will very likely be dominated by speculation on the likely timing of a US Fed interest rate…Read More

While high-yield bond followers are seemingly caught between a rock and a hard place as interest rates may be poised to pick up, some expert investors are positing that high yield positioning is precisely the tactical approach to maintain.. The following MarketsMuse.com fixed income fix is courtesy of contributed article…Read More

MarketsMuse.com update courtesy of coverage by TheStreet.com Investors should avoid the Utilities Select Sector SPDR ETF (XLU) despite the recent dovish talk by Federal Reserve Chair Janet Yellen, said Mohit Bajaj, Director of ETF Trading Solutions at WallachBeth Capital. Bajaj added that rising rates will hurt the XLU because power…Read More

BlackRock is the world's largest asset manager with over $4.59 trillion in assets under management. iShares is a section of BlackRock that is in control of hundreds of ETFs. As noted on iShares page and continued to ring true today, Many people are turning to ETFs for diversified, low-cost and tax efficient…Read More

While a certain sect of economists are lamenting the exponential increase in debt issued by an assortment of sovereign entities [and corporate bond issuers] within the context of a feared liquidity crisis if and when rates turn higher and institutional investors might run for the exits at the same time,…Read More

MarketsMuse fixed income fix is courtesy of extract from Mischler Financial Group Mar 17 desk notes aka "Quigley's Corner" and authored by Ron Quigley, Managing Director and Head of Fixed Income Syndicate for this boutique brokerdealer owned and operated by Service-Disabled Veterans and recipient of Wall Street Letter's 2015 Award…Read More

Marketsmuse.com blog update courtesy of extract from a.m. edition of Rareview Macro LLC's "Sight Beyond Sight", the global macro trading investment newsletter favored by the industry's leading hedge funds, investment managers and the world's most savvy self-directed investors. [caption id="attachment_2349" align="alignleft" width="150"] Neil Azous, Rareview Macro[/caption] -FOMC Meeting: Best Wishes…Read More

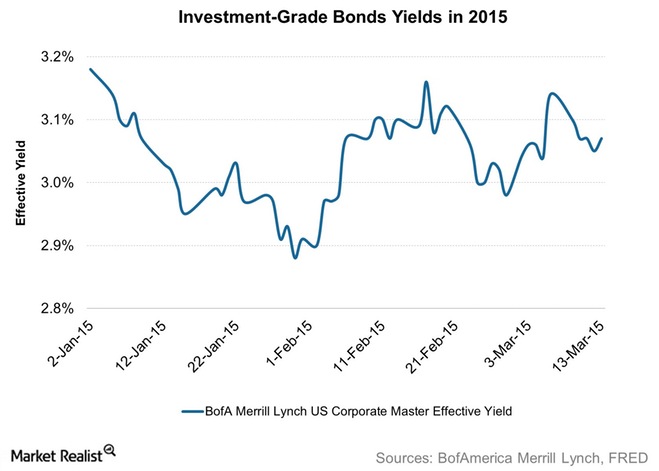

MarketsMuse global macro strategy insight courtesy of extract from today's a.m. edition of Rareview Macro LLC's "Sight Beyond Sight", which includes references to the following ETFs: EMB, HYG and LQD.. For those already subscribing to "SBS", you already know that this market strategist incorporates a cross-asset model portfolio that has…Read More

MarketsMuse update courtesy of debt capital markets desk notes distributed to clients of boutique brokerdealer Mischler Financial under the banner "Quigley's Corner". Mischler Financial, the financial industry's oldest and largest minority firm owned/operated by Service-Disabled Veterans received the 2015 Wall Street Letter Award for Best Research/BrokerDealer. [caption id="attachment_2881" align="alignleft" width="150"]…Read More

MarketsMuse fixed income and global macro update courtesy of extract from blog post at II’s blog by James Craige, the head of emerging-markets debt at Stone Harbor Investment Partners in New York. Two years of challenged returns, and high volatility, by emerging-markets local currency debt has prompted questions from investors.…Read More

MarketsMuse.com fixed income coverage profiling below zero interest rates being offered on a growing assortment of freshly-minted European corporate bonds, as well as sovereign debt issues is courtesy of extract from WSJ story by Josie Cox, Ben Edwards and Anupreeta Das. Investors snapped up a half-billion euros of French utility…Read More

MarketMuse update profiles the billions of dollars that have flowed into bond ETFs over the past few years and an in depth look at the reasoning behind it courtesy of the Wall Street Journal . Institutions are piling into exchange-traded bond funds at the fastest pace on record, driven by forces…Read More

MarketsMuse.com blog update courtesy of press release from Tabb Group and profiles new research report focused on institutional investors’ growing use of corporate bond ETFs. NEW YORK & LONDON--(BUSINESS WIRE)--In new research examining accelerating growth in the corporate bond exchange-traded fund (ETF) market, which has seen assets under management (AuM)…Read More

Are you beginning to wonder why there is an avalanche of news stories profiling corporate bond ETFs? As we’ve posted here at MarketsMuse.com, one good reason might be rising concerns that when interest rates tick up and bond prices tick down, there could be a rush to the exits on…Read More

MarketsMuse update inspired by yesterday’s column by Tom Lydon/ETFtrends.com and smacks at the heart of what certain “bomb throwers” believe could be a Black Swan event, albeit an event that may not be driven by a global crisis or surprise economic event. The event in question will, in theory, take…Read More