US Marine veteran of Operation Just Cause and Operation Desert Storm and veteran NYSE floor trader enlists with designated market-maker GTS with rank of Global Market Commentator From the USMC to the NYSE, Mark Otto re-defines the phrase 'veteran' when considering his pedigree as a highly-decorated former US Marine and…Read More

[caption id="attachment_5639" align="alignleft" width="150"] NYSE DMM Citadel Securities started as a HFT prop trading firm[/caption] Something funny happened on the way to the floor of the New York Stock Exchange last week; Citadel Securities and Virtu Financial, two of the three biggest NYSE “Designated Market-Makers” aka “DMM”) --also domain experts…Read More

Stock Price Implosion Leads Some to Challenge Current Market Structure; HFT Firms Are Under Attack, Again… Heads Up to High-Frequency Firms: Time to Hire a PR Crisis Manager Again, Call Your Lobbyists, Book Your Plane Tickets to Washington DC. Before “bidding on” to the anti-HFT and anti-ETF remarks circulated by…Read More

Trifecta Month for GTS; NYSE DMM, Quant-Trading Powerhouse and Fin-Tech Think-Tank Now Aligned With Investment Bank Specializing in Primary Debt & Equity Capital Markets GTS, the NYSE's Top DMM, and one of the global trading market's leading multi-asset electronic market-makers, is on a strategic deal-making binge. On the heels of…Read More

Goldman Sachs, the venerable investment bank and trading house, has been called lots of things, including "Squid." But nobody on Wall Street can dispute the fact that $GS is uniquely innovative and perhaps, a firm that can smell the trail of money better than its peers and explains why Goldman is…Read More

MiFID II Implementation Triggers Flow of $50b into Europe ETF Market In First Weeks of 2018; ETF Sec Lending and ETF Options Growth Expected to Drive EU Financial Markets. "What we've seen for the first time in European ETF trading is really a concerted interest in trading ETF options in…Read More

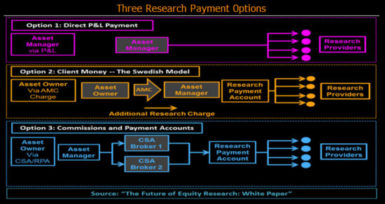

(MarketsMuse blog post image courtesy of Institutional Investor)--Thanks to MiFID II, Sell-Side Research Analysts are not only unwanted, they will become increasingly underemployed in terms of compensation, or simply unemployed. This increasing view is bleak for investment bank research wonks, but provides for a career re-purposing on the part of…Read More

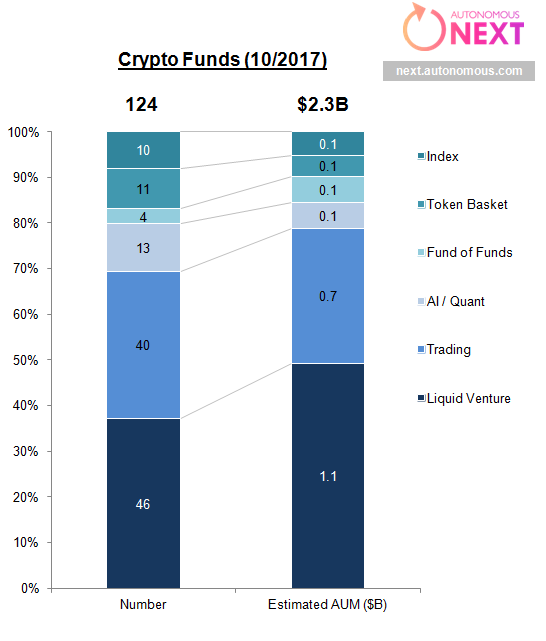

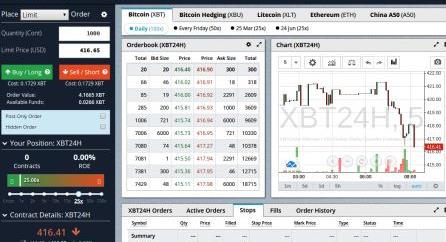

Crypto Hedge Funds Get Their Greenwich On. If the MarketsMuse curators have avoided bidding on and publishing tick-by-tick coverage of "crypto mania" and bitcoin bubblelicious bytes akin to our media industry brethren, its only because we were arguably a pioneer when, starting in 2014, we first started framing the bitcoin and distributed…Read More

Initial Coin Offerings [Finally] Get SEC Attention; The Duck Test 3.0. For those who believe the US SEC is slow to react when reining in and/or reigning over new-fangled investment products, the evidence indicates you are accurate. After all, recent history regarding sub-prime debt sold to unwary investors, Madoff-style investment…Read More

CME Aims to Legitimize Bitcoin Marketplace via..What Else? A Bitcoin Futures Mart!! Any and every credible financial market veteran will argue that any credible financial instrument can only be credible when there is a legitimate marketplace in which buyers and sellers can express their view as to the value of…Read More

Canada stock exchange regulators appear to be suffering from a pot-hangover, as exchange execs and regulators re-visit criteria for cannabis share listings. Its a high-flying industry for sure; 69 publicly-traded cannabis companies with aggregate market cap of USD $6.4bil have their shares listed on the Toronto Stock Exchange, the smaller…Read More

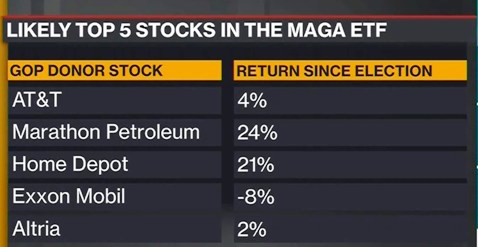

GOP-friendly ETF Set to List on BATS BZX; Exchange-Traded Fund with ticker MAGA Will Buy Companies Supportive of Republican Party Agenda We can't make this sh*t up..Just when MarketsMuse curators thought we'd seen and heard it all when it comes to new-fangled ETF products, along comes an exchange-traded fund construct…Read More

Competition for listings is a contact sport in the world of major stock exchanges as evidenced by the assortment of US bourses vying to increase market share in exchange-traded fund (ETFs), which represent nearly 2000 securities or more than half of all equities listed on major US stock exchanges. While…Read More

If you've been a professional trader for 'more than 15 minutes' (i.e. years, if not decades), you know the equities markets will move lower when (a) complacency prevails, a sense of calm is seemingly endless and equity market indices quietly creep higher and higher or (b), business news front page…Read More

Taking a Unequivocal Stand is Easier for Fortune CEOs than for POTUS--so it seems. Fortune 500 CEOs who have taken exception to erratic and equivocal statements made by the current sitting president of the United States have been systematically subjected to 'assault by Twitter' by the country's CEO-in-Chief. In turn,…Read More

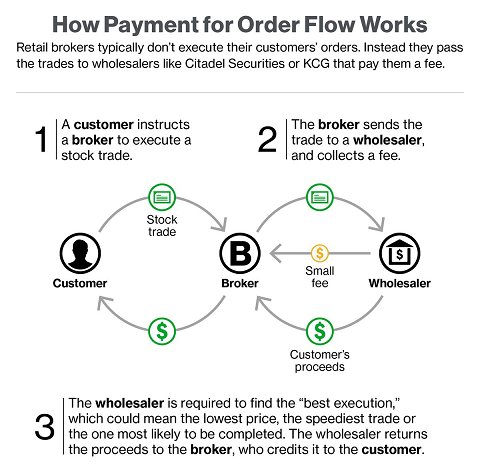

In a July 18 NYT op-ed piece "Wall Street Profits by Putting Investors in the Slow Lane" submitted by Jonathan Macey, a professor at Yale Law School and David Swensen, the chief investment officer of Yale University, the spirit debate topic of payment-for-order-flow schemes, aka rebates paid by the various stock exchanges to…Read More

Trump’s treasury team says Cuba's Vicana Sugar Company assets, including 60,000 acres of land and 48 miles of railroad belong to US investors. Ole to Compania Azucarera Vicana! Courtesy of a Trump White House that has more leaks than a rusty old pipe, sources “not authorized to speak on the…Read More

MarketsMuse Exclusive: The Trump-Russia-Estonia Government Bond connection, first disclosed three weeks ago by a MarketsMuse investigative report that linked US Treasury Secretary Mnuchin to a cache of rare, $1000 USD denominated 1927 Estonian Govt bond certificates, has a new layer of intrigue. According to Trump White House sources, last week…Read More