Speculators betting on the SEC approving the very first Bitcoin ETF listing helped push the price of the digital currency aka crytopcurrency to a record high in advance of a March 11 SEC meeting in which regulators are scheduled to determine whether the Winklevoss Bitcoin Trust ETF [proposed ticker NASDAQ:COIN]…Read More

Let's guess that more than 65% of ETF traders and investors have been clamoring for a marijuana ETF, but just when it seemed to be on the verge of happening, a bunch of folks sponsoring such an exchange-traded fund got hit with what could be a 'bad high.' The ink…Read More

Chaos is the active word to best describe the impact of President Trump's team of executive order writers, evidenced not only by the contentious 'ban on immigrant visas', but also when considering the walk back within hours of the President thinking he had signed an executive order to white wash…Read More

The 2016 BEST ETF funds and People in the ETF industry...Each year, ETF.com and Inside ETFs orchestrate a list of Best Of-the top ETF funds and ETF industry players who have made the greatest positive impact on the industry and investors in exchange-traded funds. The nomination process and voting process…Read More

ETF product use among the Buy-Side is no longer viewed as "just a portfolio re-balance or transition management tool," according to a survey of the investment industry's largest portfolio managers. More PMs than ever are finally 'getting the joke' with regard to the value proposition of Exchange-Traded Funds (ETFs), according…Read More

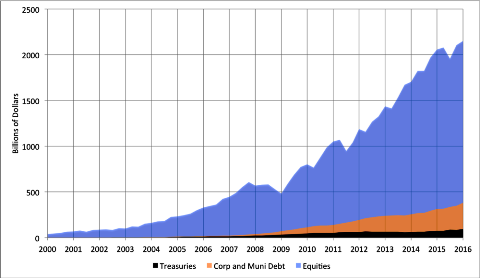

Insurance Co PMs are increasingly getting “the memo” : Exchange-Traded Funds (ETFs) Make Sense.. (Pensions & Investments) Exchange-traded funds have permeated almost every corner of the financial markets, but insurance companies have primarily kept their distance. That may be changing. Though several U.S. insurers have navigated the $2.4 trillion ETF…Read More

Following a decade of new exchange launches, which led to a series of aggressive fee competition to attract order flow and elevated the 'pay-for-order-flow' game, the more current trend towards consolidation, fueled by an industry-wide race to zero fees and commissions is sparking rumors that the CBOE and BATS are…Read More

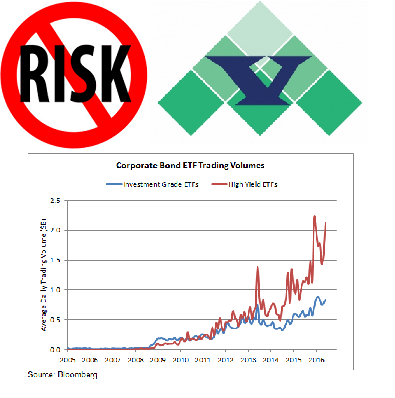

Virtu Says NO to Corporate Bond ETF risk-taking; Top Market-Maker Opines “Unable to Hedge ETF Constituents Due To Limited Liqudity” During the better part of three years, MarketsMuse Fixed Income curators have often pointed to concerns expressed by market professionals who argue that the unfettered growth of corporate bond ETFs…Read More

Just when you were about to ask "What’s the next type of exchange-traded fund that nobody else has come up with?, PureFunds has launched a fintech ETF! If you’re not familiar with the phrase ‘fintech’, you’re likely not qualified to put assets into this latest exchange-traded fund that specializes in…Read More

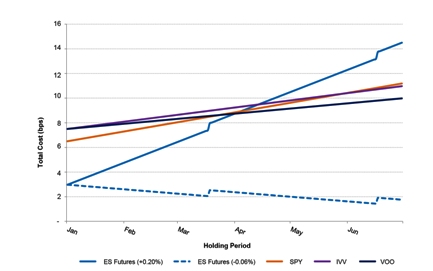

(Traders Magazine)-CME Group, the US derivatives exchange, has launched an online tool to allow investors to compare the costs of futures against exchange-traded funds, as some ETF issuers have claimed the funds are now cheaper to use. Last month the CME launched the Total Cost Analysis tool to allow investors…Read More

If you thought the ETF Issuers industry is getting crowded, you are right. While the barrier to entry is relatively low, the path to traction-measured by AUM can prove rocky, if not populated with land mines. What's an Issuer to do? Join the Pac-Man Party and sell out what you've built to those…Read More

The summer interns at MarketsMuse had already voted "Shark Tank" as their favorite TV show, so it was no surprise that our senior curators took their cue to advance the latest news from Kevin O'Leary, the celeb entrepreneur and more recently, an ETF aficionado who has extended his brand to…Read More

Now that corporate bond fund managers have proven their continuing interest in and use of bond ETFs, State Street and Bloomberg LP are joining hands in an effort to re-define the notion of "straight-thru-processing" for institutional investors that are using fixed income ETF products...MarketsMuse sends a shout-out to BusinessWire for…Read More

Bloomberg LP's agency broker Bloomberg Tradebook is continuing to grab market share in the ETF execution space thanks to introducing a blockbuster approach that has proven to work across a universe of hard-to-trade financial instruments: RFQ ("Request For Quote"). The "Bloomberg ETF RFQ" tool, which, according to a statement issued by Bloomberg…Read More

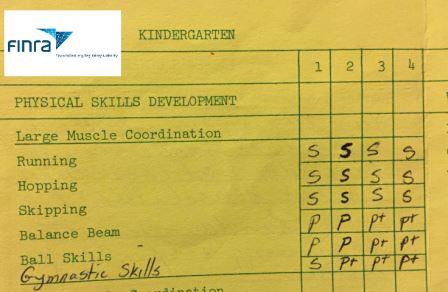

"Report Cards" Delivered to Brokerages Citing High-Speed Manipulative Practices, Including Spoofing and Layering (WSJ) --Finra, the securities industry’s self-regulator sent out its first monthly “report cards” to brokerage firms warning about manipulative superfast trading practices, marking the beginning of an effort to encourage the firms to cut off traders that…Read More

In effort to thwart the "Catch Me If You Can" crowd, the SEC has proposed a new audit system that will purportedly allow regulators to track every bid and offer submitted to stock and options exchanges in effort to catch market manipulators. (WSJ)--U.S. market regulators on Wednesday proposed a massive data repository…Read More

(MarketsMedia)--European exchange-traded fund (ETF) issuers have welcomed a new service from Deutsche Börse which aims to make it easier to trade large ETF orders on the German exchange. Deutsche Börse has launched Xetra Quote Request which allows investors to send quote requests for large orders to all registered market makers…Read More

Not to be confused with yet another social media ETF comprised of social media companies, the latest flavor in the creative world of exchange-traded funds is courtesy of ALPS Advisors and Sprott Asset Management; an ETF that tracks the performance of the BUZZ Social Media Insights Index, which in turn,…Read More