Back in the day, when “trillion dollar” was a phrase not even contemplated by film writers, and barely envisioned by financial industry wonks (other than in context of US government deficit), and when even being a billionaire was limited to a universe of less than two dozen people, (e.g. Warren Buffett and Bill Gates 25 years ago), few would have predicted that a category of financial vehicle known as exchanged-traded products (ETP), with a sub-sect comprised of exchanged-traded fund (ETF) would become mainstream. Well, ETPs and ETFs are so mainstream now, assets invested in these products have surpassed $3trillion in each of the past two years.

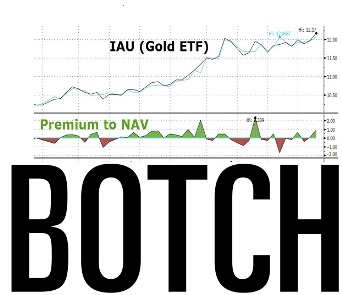

(Traders Magazine) Assets invested in Exchange traded funds and ETPs listed globally have broken through the $3 trillion milestone for the second time at the end of Q1. At the end of May 2015 the assets in ETFs/ETPs listed globally first exceeded the $3 trillion milestone.

During March 2016, ETFs/ETPs listed globally gathered $45.30 in net new assets, according to research from ETFGI, a London-based market research firm. This marks the 26th consecutive month of net inflows. The Global ETF/ETP industry had 6,240 ETFs/ETPs, with 12,042 listings, assets of $3.07 trillion, from 277 providers listed on 64 exchanges in 51 countries, according to preliminary data from ETFGI’s March 2016 global ETF and ETP industry insights report.

“U.S. equities rebounded in March ending the month up 7 percent. Emerging markets and Developed ex US markets also had a strong March ending up 12.5 percent and 7.2 percent respectively. Based on comments from the Fed there is a growing belief that interest rates will be held lower for longer than previously anticipated. The European Central Bank cut rates and announced additional stimulus will begin in April, accelerating the rate of bond purchases from 60 to 80 billion euros per month,” according to Deborah Fuhr, managing partner at ETFGI.

Some ETF numbers, via ETFGI:

In March 2016, ETFs/ETPs saw net inflows of $45.30 Bn. Equity ETFs/ETPs gathered the largest net inflows with $26.30 Bn, followed by fixed income ETFs/ETPs with $14.80 Bn, and commodity ETFs/ETPs with $2.42 Bn.

In March 2016, 71 new ETFs/ETPs were launched by 27 providers and 30 ETFs/ETPs were closed.

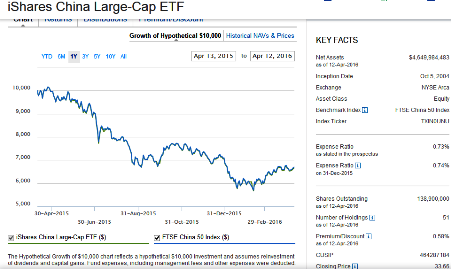

iShares gathered the largest net ETF/ETP inflows in March with US$20.97 Bn, followed by Vanguard with US$9.74 Bn and SPDR ETFs with US$6.25 Bn in net inflows.

YTD, iShares gathered the largest net ETF/ETP inflows YTD with US$24.54 Bn, followed by Vanguard with US$17.82 Bn and SPDR ETFs with US$8.78 Bn net inflows.

S&P Dow Jones has the largest amount of ETF/ETP assets tracking its benchmarks with 27.5 percent market share; MSCI is second with 14.6% market share, followed by FTSERussell with 12.4 percent market share.

Keep reading Traders Magazine story via this link

Yet an upstart fund manager called

Yet an upstart fund manager called

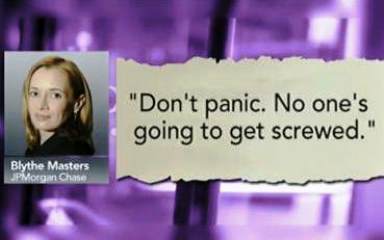

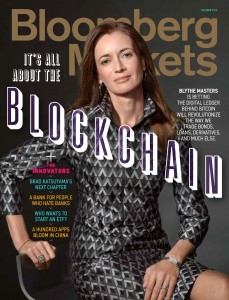

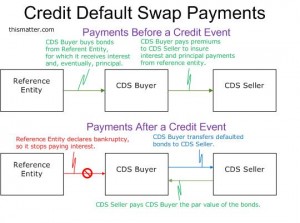

Traditionally, CDSs have been the favored hedge for corporate bond portfolios. However, regulatory restrictions and capital requirements for US banks stemming from the Basel III accords have crimped their ability to deal over-the-counter (OTC) credit derivatives. And several other rules and restrictions have further limited these banks from operating as traditional providers of liquidity and immediacy in the over-the-counter market.

Traditionally, CDSs have been the favored hedge for corporate bond portfolios. However, regulatory restrictions and capital requirements for US banks stemming from the Basel III accords have crimped their ability to deal over-the-counter (OTC) credit derivatives. And several other rules and restrictions have further limited these banks from operating as traditional providers of liquidity and immediacy in the over-the-counter market.